Zhuo Xi

July 23, 2019

Starting from the different positions held by the Trump administration and the Chinese government on issues such as the bilateral trade balance, market access, and intellectual property transfers, China and the U.S., the world’s two largest economies, have been quarreling over trade for more than a year. This post reviews a number of measures of the recent performance of China’s economy to see if there have been any discernible impacts to date. The United States has initiated two rounds of tariffs on Chinese goods. In July of last year, 25% tariffs were placed on $50 billion of U.S. imports; in May of this year, a second-round raised tariffs from 10% to 25% on $200 billion of U.S. imports. President Trump has repeatedly warned that the United States may also place tariffs on another $300 billion in Chinese goods. China has responded with tariffs on $60 billion of U.S. goods after the May tariff hike. While tariffs have affected China’s trade, and investors are worried about the possible fallout that could hit companies, whole sectors, and other countries caught in the crossfire, the actual macroeconomic implications for China appear limited so far.

Direct Impacts

Source: OECD

According to recent data, China’s GDP has slowed to 6.3% year on year in the first half of 2019 (see above figure) feeling the pinch from the tariffs imposed. However, this view ignores that ongoingde-leveraging, real estate-regulation, and environmental protection have also caused significant downward pressure on China’s economy. In fact, China’s exports surged in 2018 a move that might be related to thefront-loading impactas exporters pushed out shipments ahead of the implementation of the latest tariffs, backed also by a weaker Chinese currency against the U.S. dollar. But, it’s uncertain whether the recent resilience of exports is likely to be sustained, especially considering that the higher tariffs on $200 billion worth of Chinese goods will soon take effect. In fact, both the World Bank and the International Monetary Fund (IMF) have lowered their forecasts for China’s future GDP growth.

Source: World Bank

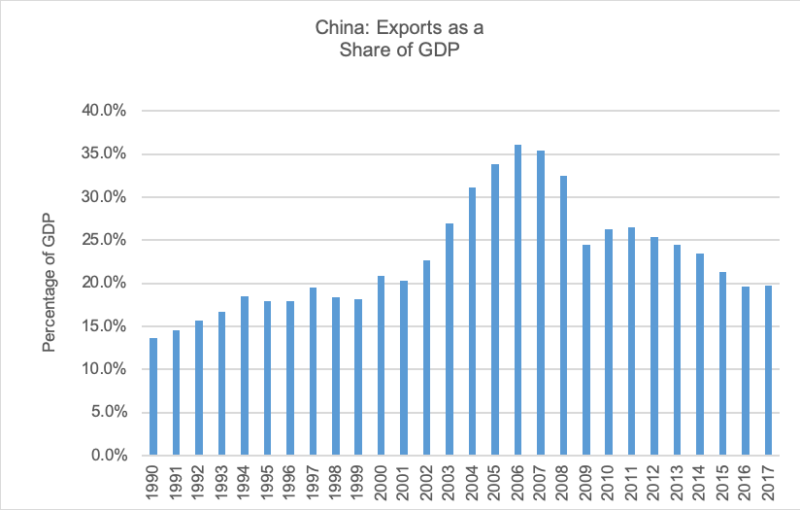

Although the trade war between the two countries threatens to become much worse in the future, the direct impact on GDP is still limited in the long- term, since China’s economy is no longer mainly driven by exports. According to the data from the World Bank (above figure), exports accounted for roughly 20% of China’s GDP in 2017, down from 36% in 2006. Also, bilateral trade between the two countries contributes an even smaller amount to GDP. For China, U.S. trade contributes 2.5% to GDP while only 1% for the U.S.

Source: FRED

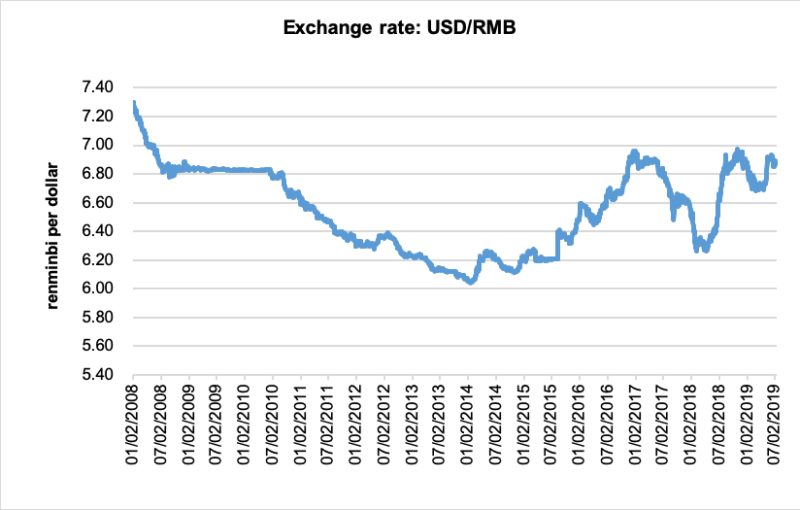

Since China’s trade dispute with the United States, China has seen its currency, the renminbi (RMB), decline in value. Although the decline has not been as steep as that of the Turkish lira or the Argentine peso, whether China will also fall into a similar monetary crisis has been an important question for investors. Although the RMB is depreciating, one difference is that China has responded to the trade situation by allowing a moderate and controllable RMB depreciation. Generally, the policy has been to intervene and stabilize the value of RMB within the range (band) of 6 and 7 per US dollar. This should help Chinese exporters mitigate the impact of new tariffs, but it will cost the rest of the economy. In other words, contrary to other emerging market, the depreciation of the exchange rate is more intentional and controllable by the government.

The reason behind this trend is that China’s economic base and ability to control the exchange rates are hard to match in other emerging market countries. This point could be reflected by the recent variation of USD/RMB, where there was clear support when the rate approached 7. On the other hand, various Chinese financial governors have mentioned several times in the media that China won’t use devaluation as a tool in the trade dispute. The possible reason is that the internationalization of the RMB has been one of the top goals for Chinese financial development. In fact, the People’s Bank of China has just managed to successfully convert the one-way renminbi devaluation expectation of the market into the two-way currency fluctuation expectation in recent years. Based on these two considerations, a rapid depreciation of the RMB is not likely in the near future. However, if the trade conflict between the US and China has escalated to a financial war, then the possibility of strong depreciation cannot be ruled out.

Debt condition

There is a widespread view that an escalation of the tariff conflict could trigger a possible debt crisis in China and an increase of debt-to-GDP ratio due to deceleration of the GDP growth rate. But unlike the case of Turkey (and even Argentina’s), where the external debt position was almost 55% of GDP, equivalent to about 5.4 times the level of its foreign exchange reserves, China’s debt is mainly domestically held, while the external part is considered sustainable. Furthermore, China holds considerable USD exchange reserves-one third in the form of US Government securities-and given the slowly opening of its capital markets it can decisively control any capital outflow.

Impact on the Stock Market

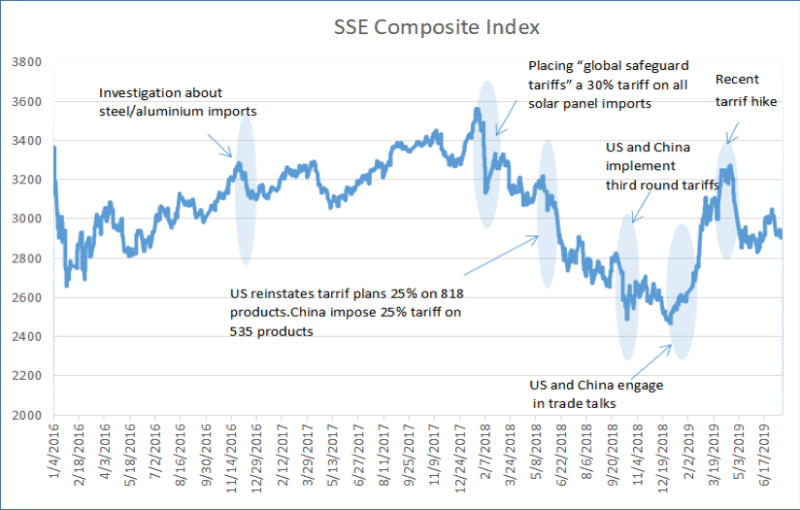

The stock market is probably the place that will face the greatest impact. Global investors are worried about the continuous escalation of the US-China trade war. Since the beginning of 2018, China’s stock market has gradually fallen. At the end of the last year, the Shanghai Composite Index (SSE) once fell below 2,500, and the year-to-date decline was close to 30%. The trade dispute between the US and China had been one of the main causes for investor pessimism. To prevent a possible market crash, the top officials of the Chinese Government collectively called for stable expectations. In addition to the optimism over the prospect of a possible deal, the stock market bounced back in early 2019. However, immediately after President Trump increased tariffs on $200 billion worth of Chinese goods, the stock market has fallen sharply below 3,000 again.

Source: Yahoo Finance

Other Potential Impacts

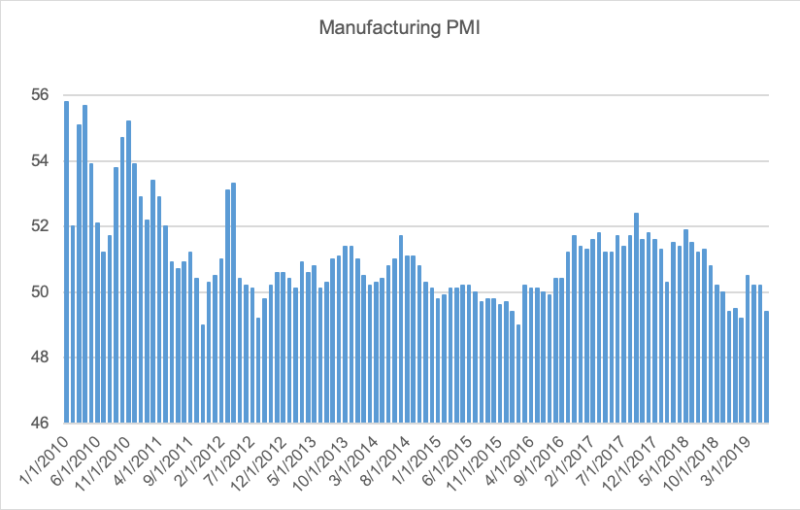

In addition to the declining stock market, the impact of Sino-US trade frictions on China’s economy is gradually moving from the expected and psychological levels to the physical level, from local to global, including trade, investment, the supply chain, employmentand so on. For instance, the impact on the industrial chain cannot be underestimated; such effects are difficult to model quantitatively. For example, due to concerns about the uncertain future of the Sino-US trade war, more and more multinational companies are hesitant about continued investment in China and are gradually adjusting their global profile. According to survey reports, in order to avoid high import tariffs in the United States, large Japanese manufacturers have been re-examining their business strategy and have plans to transfer production lines out of China. The effects of the concern regarding a U.S.-China trade war can be reflected in the recent variation in the manufacturing PMI (Purchasing Managers Index): the PMI had declined to an annual low of 49.2 since the trade dispute. It rebounded back above 50 in recent months due optimism over a possible deal, but it fell again to 49.4 due to recent tariff hike.

The Purchasing Managers’ Index (PMI) is based on a monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity. The headline PMI is a number from 0 to 100. A PMI above 50 represents an expansion when compared with the previous month. A PMI reading under 50 represents a contraction, and a reading at 50 indicates no change.

Source: The National Bureau of Statistics

The future of the US-China relationship will be essential not only for their wellbeing but for the global economy. Recent news surrounding Huawei and other Chinese tech companies suggests that the bilateral tensions between the two countries have expanded beyond the damaging trade war, and are headed for a keen rivalry in technology and innovations. With the APEC (12-member Asia Pacific Economic Cooperation) meeting in November, it’s possible for the U.S. and China to reach a “narrow” trade deal by the end of this year, but by no means to resolve all the tensions between the two countries. In the long- term, geopolitical experts have been warning that China and the US appear to be falling into the “Thucydides Trap”, which describes a situationin which a war between two countries is inevitable even though both nations may be trying their best to avoid it.