By Zhio Xi

April 30, 2021

The issue of supply chains has been one of the most discussed economic topics in China recently. Since joining the WTO in 2001, China’s integration into the global economy has been accompanied by the reshaping of the global supply chains. Many foreign companies have transferred part of their production to China to enjoy lower labor costs. However, with the gradual increase in labor and environmental costs in China in the past decade, various companies have thought about moving production out of China. The trade conflict between the US and China in the past couple of years and the recent COVID-19 pandemic crisis greatly heated up such discussion. For instance, according to a 2020 survey of over 200 global supply chain leaders, one-third had moved manufacturing activities out of China or planned to do so in the next 2-3 years due to the global pandemic condition as well as US-China trade tensions. This article mainly addresses the impact of the Covid-19 pandemic on the supply chains in China.

The Shock of Covid-19

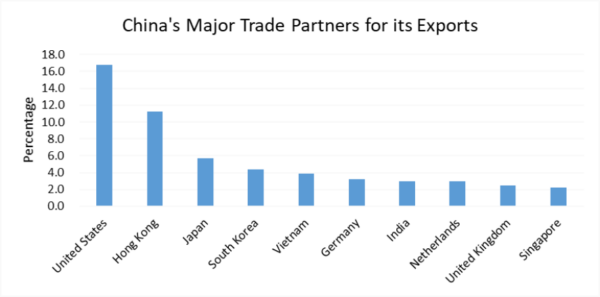

In terms of the Covid-19 pandemic, the impact on supply chains in China can be analyzed in terms of the trade of intermediate goods, or goods that are used as inputs into the production of final goods. The impact has two aspects. On the one hand, supply chains can be disrupted by the current and post-pandemic situations in the economies of China’s major trading partner countries and would affect directly Chinese exports to the United States, Japan, and Korea. The effects are bilateral: the lack of demand due to the lockdown in these countries can impose pressure on China’s supply chains, as foreign producers cut back on their imports of China’s goods. The possible future waves of Covid-19 in China and the associated costs and uncertainties may challenge producers as well.

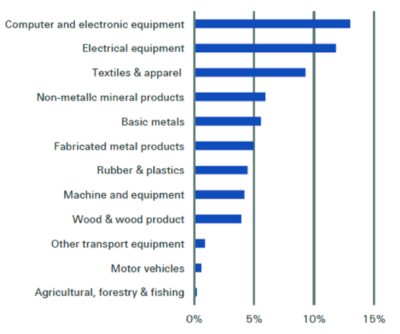

Source: OECD, 2019

Note that these trade partners rely heavily on Chinese exports such as computers, electronics, electrical equipment, and textiles. The Chinese exporters in these sectors, in turn, are sensitive to demand shocks, especially those arising from subsequent waves of Covid-19 in these trade partners. For China, the major trade partners for intermediate goods imports are South Korea, Japan, and the US. The main imported goods are electronics and chemicals. Therefore, put together, the computers, electronics, textiles, and chemical industries in China’s manufacturing sector will see the largest impact during the pandemic. Among those industries, firms that rely highly on imported goods with high value added (high tech) are more fragile than firms that can find substitute source countries. For instance, firms associated with optical imaging, medical equipment, vehicle components, printed circuit boards (PCB), and integrated circuits (semiconductor) should be well prepared for the future uncertainties associated with pandemic. Chinese intermediate goods imports as a percentage of total global output (ex-China) by industry

Chinese intermediate goods imports as a percentage of total global output (ex-China) by industry

Source: Swiss Re Institute (2020)

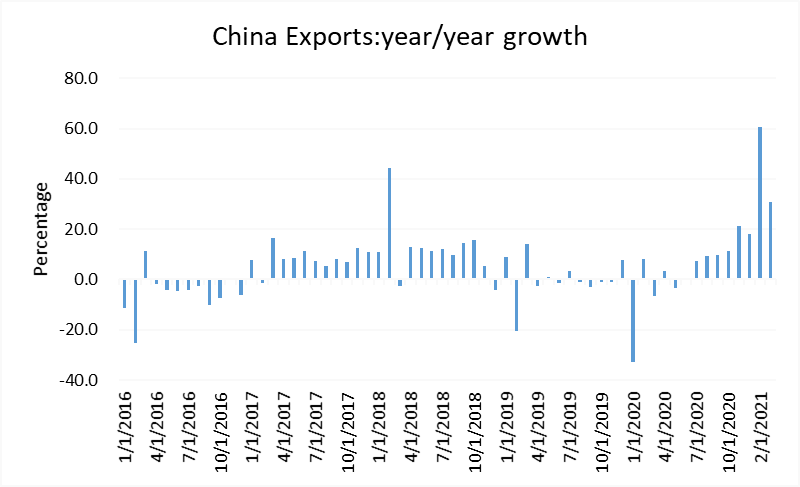

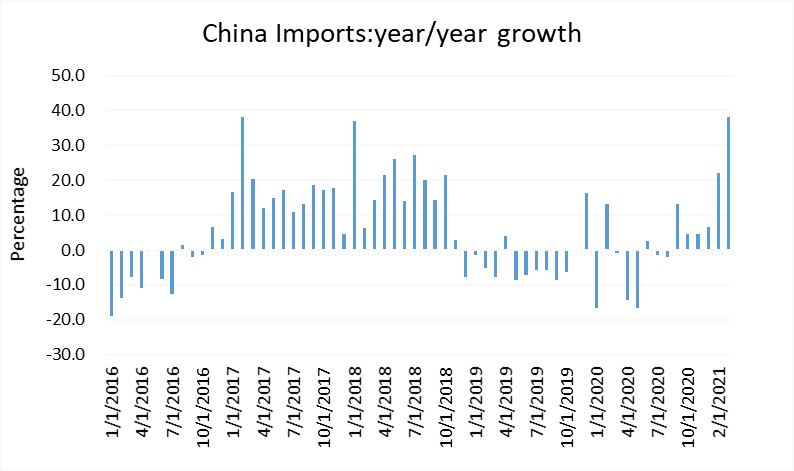

There is no doubt that the global supply chains are getting increasingly connected and complex, thus the real long-term impacts of the pandemic are yet to be known. China is a big importer of raw materials and a major exporter of labor-intensive goods used as intermediate goods in final production (according to one estimate, China’s world share of labor-intensive exports is 27%). One aggregate indicator that shows the effect of COVID-19 on China’s trade to date is the trend in exports and imports. The graph below shows that China’s exports have begun to recover from the sharp decline at the start of the pandemic, mid-summer 2020.

Source: General Administration of Customs

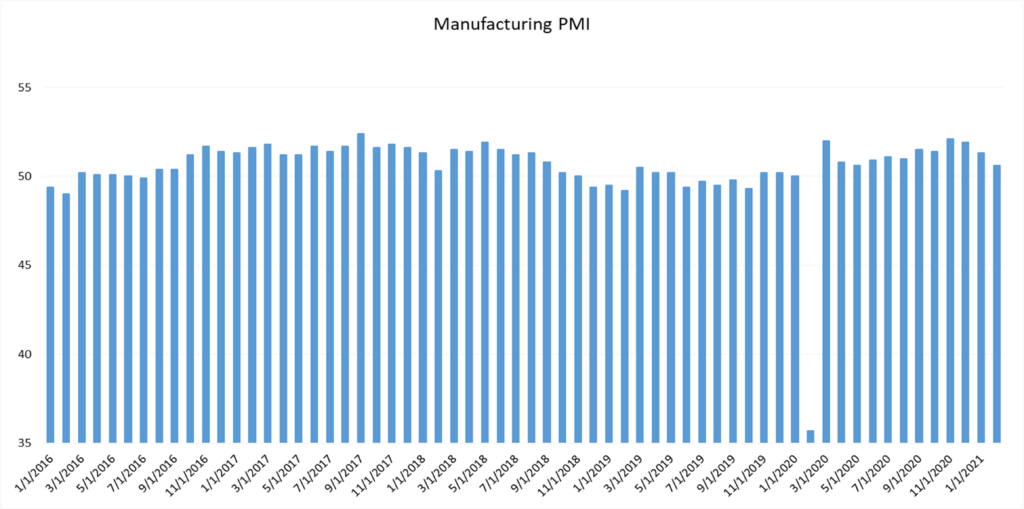

Another timely measure of the effects of the pandemic on the supply chains in China is the recent variation in the manufacturing PMI (Purchasing Managers Index, figure below): the PMI had declined to a record low of 35.7 due to the Covid-19 pandemic, but it rebounded back above 50 in twelve successive months following the virus outbreaks in China.

The Purchasing Managers’ Index (PMI) is based on a monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity. The headline PMI is a number from 0 to 100. A PMI above 50 represents an expansion when compared with the previous month. A PMI reading under 50 represents a contraction, and a reading at 50 indicates no change.

Source: The National Bureau of Statistics

Both the trends in exports and exports, and the PMI pattern illustrate several points: the impact of Covid-19 was sudden and huge; the virus was contained in a relatively short time and the supply chains in China show some resilience.

A Stress Test

Despite having the world’s largest population size as well as some of the biggest cities, China has become one of the first countries to recover from the pandemic with relatively limited damage. But it is one thing to contain the virus successfully, it is another to reboot the supply chains after the lockdown of the entire country. To some extent, the Covid-19 pandemic acted as a natural stress test for the country’s economy, the government response as well as supply chain resilience and stability. One lesson that supply chain leaders may learn from this pandemic crisis is that instead of pursuing low cost and high efficiency, firms should also focus on resilience and stability. To reach such balance between efficiency and resilience, supply chain leaders may consider measures such as creating more inventory and capacity buffers, as well as diversifying their sourcing or manufacturing bases.

The Future

To keep China as a destination country for foreign firms, one of the leading priorities of the government policies has been the development of the supply chains, especially during the era of pandemic crisis. The government measures are in two main categories: 1) further opening of the Chinese markets to global investors; 2) increasing domestic innovations and development. The measures collectively belong to what the media called “dual circulation” strategy. Such measures are expected to help China reach the goal of offshoring low-value manufacturing of goods and services but maintaining the safe and stable environment for the high-value global supply chain leaders.

The future of the world is highly uncertain. Firms in the global supply chains will gradually find their balance between risks and rewards. As a result, China’s role in the supply chains may get more quality-driven instead of quantity-driven.