James Orr and Merih Uctum

February 10, 2021

Governor Cuomo recently announced the NY State budget for this year, the FY 2022 Executive Budget Financial Plan. Is New York in a deep budget hole? Will a new Federal spending bill help? In this post we dissect the executive budget and examine how economic developments affect budget projections and the bottom line for the current budget plan.

The plan projects the state’s revenues and expenditures, as well as any shortfalls in revenue, for the current fiscal year FY 2021, which began on April 1, 2020 and ends on March 31, and for each of the four subsequent fiscal years. The focus of interest is the potential shortfall of revenues in the remainder of FY 2021 and FY 2022 and the economic costs imposed on the state by the COVID-19 pandemic. It also considers the potential receipt of some additional funds from a new Federal economic stimulus bill now being negotiated in the Congress. But the plan recognizes the risk of revenue shortfalls and the uncertainty of any Federal assistance, and proposes some state income tax increases and new sources of revenue. The budget will now be discussed by the legislature and a final state budget will be enacted for the April 1 start of FY 2022.

The New York State Executive Budget

The executive budget presents the planned disbursements and the sources of revenues to fund those disbursements for each fiscal year. The final budget is enacted after discussions with the legislature and then updated quarterly. When we talk about the state budget we need to note first that there are three separate but related budgets, or funds, each with specific categories of revenues and disbursements.

The General fund is where most state tax revenues go. The categories of spending within the fund include state assistance to local areas, Medicaid and state agency operations. Medicaid is a particularly important item in the state budget because, as a program where costs are shared between the Federal and state government, the Federal share can be increased to reduce the burden on the state, even as the number of people in the program rises. Total revenues in the General fund were $79.2 billion in FY 2020.

The State fund is a broader concept which includes the General fund plus additional sources of state revenues, such as debt service funds, that help to fund state operations. It is normally considered as the state’s basic operating fund.

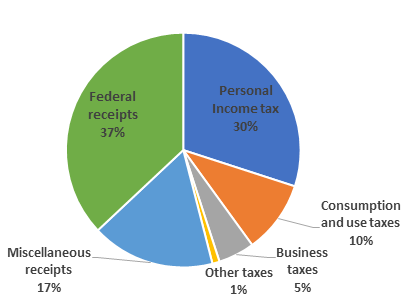

The third fund is the All funds measure which includes most of the State fund and federal monies which are used by the state to directly fund some categories, such as transportation spending, as well as joint federal-state programs. Total All funds receipts reached $177.4 billion in FY 2020, and the sources of funds in FY 2020 are shown in the figure below.

Figure 1: NY State FY 2020 revenue sources

Source: Mid-Year Update | FY 2021 Financial Plan (ny.gov) (Tables 15, 26).

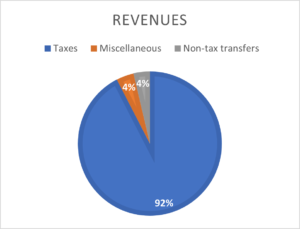

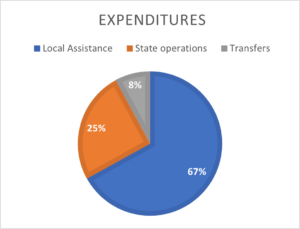

The state is required to balance the General fund budget each year, broadly defined as having sufficient revenues to fund the planned disbursements. The figure shows that about 46% of revenues from all sources come from taxes, and most of those tax revenues are placed in the General fund. The broad categories of revenue and spending in the General fund in FY 2020 are shown below.

Figure 2: Shares of revenue and spending in the General fund: FY 2020

Source Financial Plan | NYS FY 2022 Executive Budget (page 29).

The amount of the tax revenues in the fund depends heavily on the income, business, sales and other tax revenues that are generated from economic activity, and projecting activity is key to projecting tax revenues. An example of the variability inherent in projecting revenues is the projection of tax receipts before and after the onset of the pandemic. The executive budget for FY 2021 was presented in January of 2020 and projected tax revenues of $77.1 billion, following the receipt of $72.2 billion in FY 2020. Between February and April the state lost over 900,000 jobs, about 20% of employment, as the economic fallout from the pandemic hit hard and the enacted budget for the fiscal year that began on April 1reduced projected tax receipts to $61.9 billion. The mid-year fiscal update further lowered those revenue projections to $59.1 billion as activity continued weak in the summer. A pickup in activity in the fourth quarter of 2020 raised projected revenues for the fiscal year to $62.4 billion. These changes in the tax revenue projections get great attention as the state needs to bring the General fund into balance.

Because the pandemic and its economic impact were felt broadly across all states, the Federal government passed four measures in 2020 to help alleviate the problems of workers, small businesses, and state and local governments. The largest bill, CARES Act, had $2.6 trillion of spending that included a coronavirus relief fund (CRF) to cover costs to state and local governments related to the pandemic. The categories covered included public safety, personal protective equipment, medical equipment, emergency response activities, and testing. New York received roughly $6 billion in funding for these activities. Currently, the state has regained only half of the jobs lost in the early months of the pandemic and there is still uncertainty about the future for the state and the nation.

Current Projections for FY 2021 and FY 2022

Projections for FY 2021 and FY 2022 in the General fund show a shortfall in revenues: $4.7 billion in FY 2021 and $10.2 billion in FY 2022, or a $15 billion two-year gap. The state has proposed cutting spending and raising revenues to bring the budget into balance. Below we reproduce the state’s plan to close these gaps in FY 2021 and FY 2022. The positive numbers in the table indicate either increases in revenues or declines in spending, and we highlight several key entries.

| Table 1: Executive budget gap-closing plan (millions of dollars) |

|||||||

| UPDATED “BASE” BUDGET GAPS | FY 2021 (4,772) |

FY 2022 (10,201) |

|||||

| Local Assistance:1 | |||||||

| School Aid/Local District Funding Adjustment | 0 | 1,506 | |||||

| Medicaid | 1,230 | 599 | |||||

| All Other | 991 | 1,265 | |||||

| Agency Operations | 44 | 110 | |||||

| Debt Service/Capital Projects New Revenues: |

517 | 135 | |||||

| PIT High-Income Surcharge | 0 | 1,537 | |||||

| PIT Middle-Cl ass Tax Cut One-Year Pause | 0 | 394 | |||||

| All Other | 17 | 60 | |||||

| Federal Resources: | |||||||

| CRF | 2,476 | 0 | |||||

| Medicaid FMAP | 497 | 995 | |||||

| FEMA Reimbursement | (1,000) | 600 | |||||

| Unrestricted Federal Aid | 0 | 3,000 | |||||

______________________________________________________________________________

|

|||||||

Focusing on FY 2022, the largest spending cuts are in the categories of planned state aid to localities, $1.5 billion, or about 3% of this assistance, largely from changes in reimbursements to school districts. These cuts effectively shift some of the burden of state revenue shortfalls down to cities and towns. Medicaid spending is also cut by $600 million with the cuts planned to come partly from increased program efficiencies. Proposed FY 2022 new revenue sources include a high-income surcharge, which will raise revenue by $1.5 billion through a 2 percentage point increase on taxable income above five million dollars, to 8.8%, and a pause in the reduction of income tax rates on middle-income taxpayers which yields an additional $394 million.

Federal aid

Federal resources are also seen as potential sources of new revenue. The CRF revenues are projected to run out but Medicaid reimbursements will remain high. Spending in FY 2020 for emergency relief is expected to be reimbursed by FEMA (Federal Emergency Management Agency) over the next several years. A key factor in the projections is whether the proposed Federal stimulus bill with $350 billion for state and local governments will be passed. No such aid was contained in the December 2020 Federal stimulus bill and its inclusion in the bill now being negotiated is uncertain. The state gap closing account assumes it will receive $6 billion in unrestricted aid and allocates $3 billion in FY2022 and the same amount in FY 2023. Higher levels of aid will eliminate some of the pressure to cut spending and/or raise taxes.

Outlook

The outlook for the state budget depends on numerous factors, but key among them are progress in controlling the spread of the COVID-19 virus. New waves of the virus this winter or spring could lead to a further clampdown on economic activity. The strength of the recovery in the nation and state economies will determine the path of tax revenues going forward. Risk abound, but a break out of pent-up demand as the virus abates would give a needed boost to the economy and revenues. Finally, should the Federal stimulus bill currently being negotiated provide significant unrestricted aid to states and localities there is a potential to avoid any of the cuts and tax increases in the current gap closing plan.