Fadime Demiralp and James Orr

October 31, 2018

Employment data through the third quarter of 2018 show job growth in New York City and State continuing to moderate from the relatively high rates reached earlier in the recovery. In this post we examine the sources of this cooling off of job growth by focusing on employment trends in key sectors that make up the city and state economies. In New York City the latest numbers show jobs growing fairly solidly but well off their heady pace in 2014 and 2015. Beginning mid-year, the city’s year-over-year job growth rate fell below the comparable nationwide rate, reversing a pattern that had held for much of the eight years since the recovery of employment got underway. Statewide, job growth had tracked the nation fairly closely but has been moderating as well and has also fallen below the nationwide rate.

Employment Trends in New York City, the State and the Nation

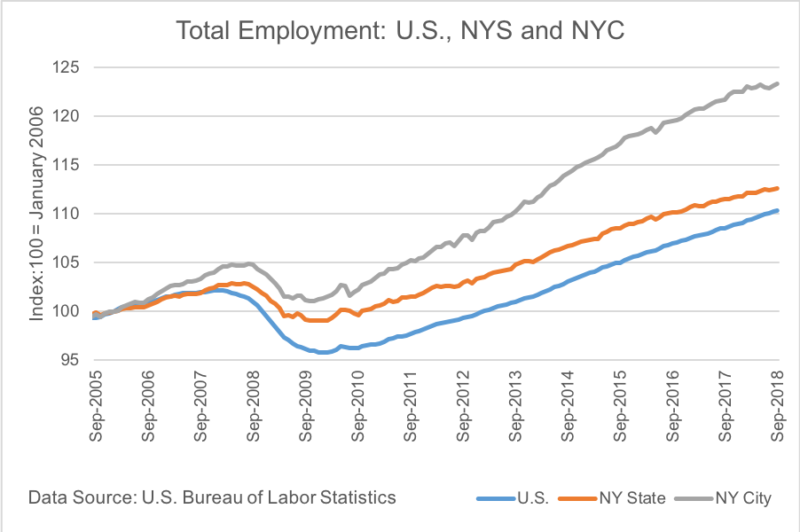

Employment patterns in the current cycle are shown in the figure below. The figure, also presented here, plots a monthly index of the level of total employment in New York City, New York State and the nation from January 2006 through September 2018. The figure shows the decline in employment during the downturn and the subsequent recovery and expansion.

In New York City, the recovery of jobs has been relatively strong and the level of employment in the city is well above its previous peak. An index of coincident economic indicators for the city, a summary statistic that measures the monthly change in overall economic activity, shows a similar pattern of recovery and expansion. Statewide, employment was somewhat slower to recover and though job counts have been above their previous peak for about five years.

Both the city and the state plots have become somewhat less steep in recent years, and a comparison of monthly job growth rates highlights this moderating growth. In the figure below, year-over-year job growth rates in the nation were relatively steady in the recovery, roughly in the range of 1.5 – 2.0 %. In New York City, recent job growth rates are down from previous months and for roughly two years have been down from gains in excess of 3.0 % in 2014 and 2015. Growth rates remained above the comparable national rate until recently. Statewide, job growth rates, which had tracked those of the nation during much of the recovery, declined over the past year to about 1.0%.

This uneven pattern of recoveryacross New York State reflects a disparity between the relatively rapid growth of jobs in the city and the slower growth rates in the metropolitan areas in upstate and western New York. This disparity continues to characterize the pattern of employment change in the state.

Sources of Moderating Growth in New York City

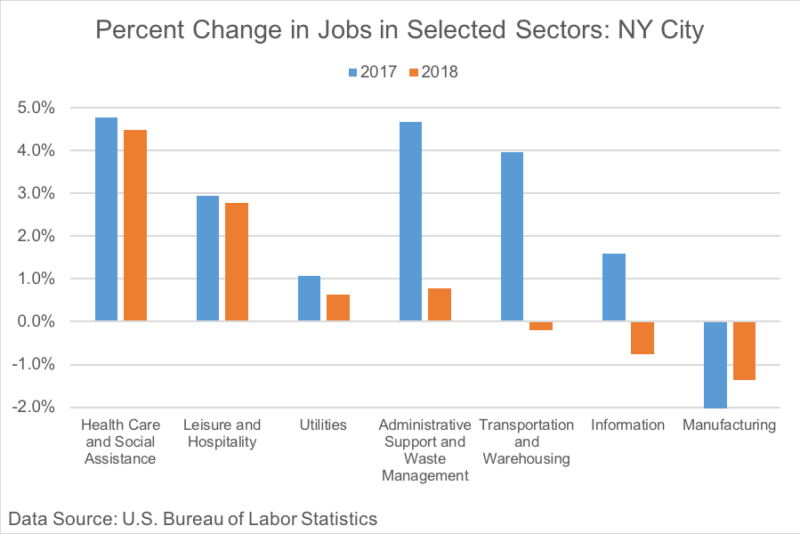

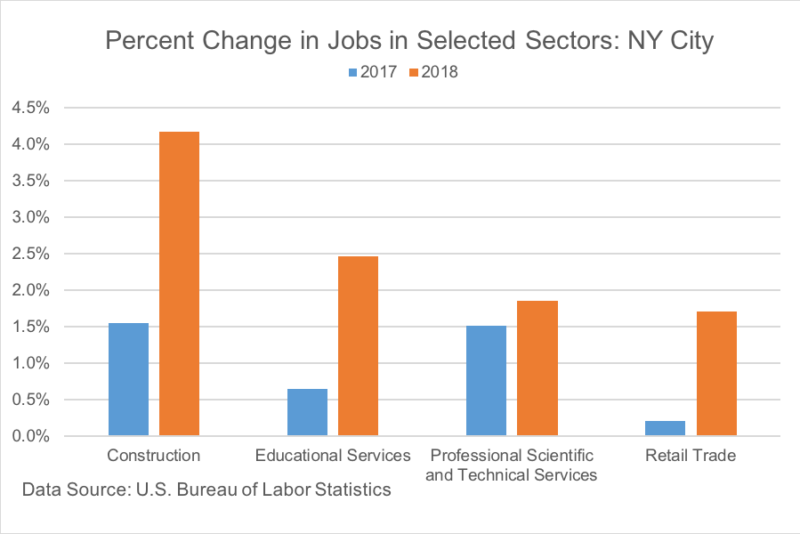

We look for the sources of moderating job growth by selecting key sectors and comparing the job growth rate in the third quarter of 2018 over a year ago to the growth rate of employment in the third quarter of 2017 over a year ago. A mixed performance is seen in the figures below. The overall slowing reflects a combination of moderating growth rates in some very large sectors, some outright declines in others, with some sectors gaining, though not by enough to offset the declines.

A first grouping includes two relatively large sectors—Healthcare and Social Assistance and Leisure and Hospitality. Job growth here was quite strong in 2018 but nevertheless modestly below that in 2017.

Healthcare and Social Assistance has the largest share of employment in the city, and also in each of the boroughs other than Manhattan, and has been a steady and robust source of new jobs. Declining growth trends in both sectors were also observed at the state and national levels suggesting a more general pull back from earlier growth rates may be occurring. The size of the two sectors, almost 30 percent of city employment, suggest any slowing will have an outsized impact on overall job growth.

A second group consists of five sectors which had relatively slow growth or declines in employment. The Utilities and Administrative Support and Waste Management sectors increased only modestly, and jobs in the Transportation and Warehousing, and Information sectors declined modestly following their sharp expansion a year ago. A recent report looking into the size of the independent contractor workforce, or the gig economy, noted that the Ground Transportation component of the broader Transportation sector in the Greater New York area had sizeable growth in non-traditional taxiing services which rely on app based systems, such as Uber and Lyft.

Manufacturing is included with this group as it had declining employment both in 2018 and 2017. At the national level, manufacturing employment expanded modestly in 2018, roughly 300,000 jobs, concentrated in the durable goods category. That pickup, however, was not reflected in job counts in either New York City or New York State.

A third group consists of four sectors that saw job growth increase in 2018—Construction, Educational Services, Professional, Scientific and Technical Services, and Retail Trade.

Construction jobs saw a healthy pickup in 2018 which also occurred in New York State and nationwide. Jobs in the Educational Services sector picked up in 2018 over 2017 despite the slowing growth in the sector at the state and national levels; Professional, Scientific and Technical Services sector saw a modest pickup in growth in 2018, and that pickup was also seen in the sector nationally.

Retail Trade improved upon its flat performance in 2017. Recent reports have attributed declines in employment in department stores in the city, a component of the general merchandise store category, to the growth of online shopping, and jobs in the general merchandise category declined more than 3 percent in 2017. However, there was only a modest decline in jobs in general merchandise stores in 2018, offset to some degree by growth in some other categories, such as furniture, food and beverages and health and personal care stores.

The Finance and Insurance sector saw a very modest pickup in jobs. The sector plays a critical role in the overall city economy, less so for its employment growth and more so for the relatively high incomes earned: 30 percent of total city earnings and average earnings of over $400,000 statewide in the securities component of the industry.

Looking Ahead

Two recent reports forecast job growth in New York City to continue slowing over the next several years, though the annual rate of growth is still expected to remain above 1.0 percent through 2020. Several factors can influence the outlook. Among them is the performance of the national economy where a weaker than expected expansion could further weigh down employment growth in the city. A second is more local and relates to the provision in the recent tax bill, the Tax Cuts and Jobs Act of 2017, which caps the size of the individual federal tax deduction for state and local tax payments. It remains to be seen how this provision will impact the state and city economies in the coming years.