New York Labor Market Developments

James Orr

December 21, 2016

The jobs data for the third quarter of 2016 showed statewide employment levels up 1.2 percent over the same period in 2015, somewhat below the comparable national rate of 1.7 percent. Across the state growth rates varied quite a bit though New York City continued to drive the expansion. The more than 23,000 jobs added in the city in the quarter helped to increase employment 2.1 percent over the prior year and to raise the city’s level of employment to a record high.

These figures point to different trends in current job growth rates in New York State, New York City and the nation, which were pointed to in a recent presentation. In fact, the differences in the patterns of employment decline, recovery and expansion between New York State and New York City, and between New York City and the nation did not just develop recently but have been quite sharp over this cycle. In this blog we review these employment patterns and delve further into labor market developments since the jobs recovery began in 2010.

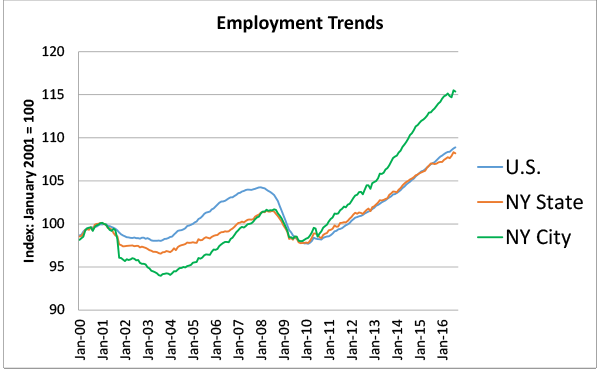

The figure below traces out the patterns of monthly employment changes from January 2000 to September 2016 in New York State, New York City and the nation and provide a context for the discussion of the current cycle. One of the first things to note is that the strength of the job growth in New York City in this upturn is remarkable in that it reverses the pattern seen in the downturn of the early 2000s. Then, the city’s downturn was significantly deeper than that of the state and the nation, and a full recovery to pre-downturn levels in the city didn’t occur until almost three years after the nation had recovered. In the recent downturn, however, neither the state nor the city saw a job decline as steep or prolonged as the nation. In the city, which has about 45 percent of the jobs in the state, the recovery began in 2010 and was quicker and the expansion more rapid that both the rest of the state or the nation.

Three significant developments have accompanied this relatively rapid growth of jobs in the city since 2010. First, the city’s population has expanded sharply. From 2010 to 2014 the city’s population, supported by positive net migration, expanded 4.6 percent, an average rate of growth stronger than any seen in the city since the 1920s. Population statewide grew an average of 1.8% over this period more in line with the nation. The rapid population growth in New York City over this period was also a sizeable increase over the growth rate recorded in the city over the prior decade and both supported and was supported by the rapid growth in employment. This rapid growth is also consistent with the notion of an increasing attractiveness of urban areas more generally, and recent population growth rates in a number of big cities has been considerably faster than in the prior decade, and earlier, including Los Angeles, Philadelphia, San Francisco, Dallas and Washington, D.C.

Second, the labor force participation rate in the city has risen since 2010. Nationally, the labor force participation rate, or the share of the population that participates in the labor force, has been problematic in this cycle. The participation rate fell from its pre-recession value of about 66.0 percent to a cyclical low of 62.4 percent, and the third quarter reading was only slightly higher at 62.8 percent. In New York State, the pattern was similar but not as drastic, with the rate declining from a pre-recession annual average high of about 62.7 percent to 61.4 percent for all of 2014 and recovering modestly to 61.1 percent in 2015. In New York City, however, the participation rate rose from 59.9 percent in 2010 to 61.0 percent for all of 2015. Unlike the nation where demographics—the ageing of the population—contributed to the declining participation rate, a recent report suggests a key part of the reason for rising labor force participation rates in the city since 2010 is also demographics—the city’s attractiveness to a younger population with relatively high rates of labor force participation.

While the increased participation in the labor force is encouraging, a key measure of how New York residents are faring is the unemployment rate, or the share of the labor force without jobs. Despite the strong job growth performance in New York City, its 5.8 percent unemployment rate in the third quarter 2016, though well off its peak rates in 2010, remains above the 4.9 unemployment rate in the nation. The U.S. Bureau of Labor Statistics now reports a number of alternative of the underutilization of labor for the nation, New York State and New York City. The broadest of these measures, termed U-6, includes with the unemployed those who want work but did not actively look in past four weeks and who want full-time work but are working part-time for economic reasons. The latest readings cover the period from the fourth quarter of 2015 through the third quarter of 2016. The 9.5 percent rate for New York State and 9.9 percent for New York City, are both much higher than the unemployment rate though quite close to the 9.8 percent rate nationwide. Nevertheless, while these measures for the state and city are well off their recession highs, in the range of 16.0 percent, they suggest that there is still room for an expansion of opportunities for New Yorkers seeking employment. –

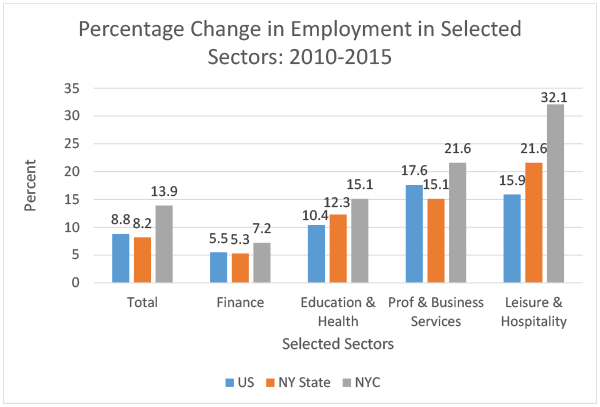

The third striking feature of this expansion of jobs in the city is the fact that it has not been led, as it has in prior recoveries, by job growth in the city’s key financial sector. While still a major force in the city’s economy, generating about a fifth of total city earnings, jobs in the sector have been essentially flat over this period. The sources of growth have been in an array of traditional services sectors, including the education and health and leisure and hospitality sectors, and in the city’s emerging tech sector. While there is no established definition of the component of the tech sector, a recent report aggregated jobs in a number of sectors where the firms used technology as the core of their business strategy. That report showed that tech jobs defined in this way more than doubled between 2007 and 2014 and contributed significantly to the city’s overall job growth.

Looking ahead, there is some evidence of a slowing in the employment expansion in both New York State and New York City. In particular, measures of economic activity point to a developing weakness in recent months. For the city, longer-term forecasts show job growth decelerating over the next several years though annual employment growth rates are projected to remain at or above 1.0% through 2020.

We will get a better read on labor market trends over the past year with the release of the annual revisions of the employment numbers in the spring. These new estimates will give a better sense of the momentum the city and the state will carry into 2017.