Mark G. Sheppard

June 29, 2025

Passing H.R. 1, the One Big Beautiful Bill, and clearing the vote threshold remains difficult for conservatives because the exact number of votes needed is somewhat challenged and even under lower threshold requirements the conservative coalition face opposing pressures. While the political future of the bill remains outstanding, evaluating the policy impact is also difficult as many of the analyses about the cost vary considerably, particularly the gap in deficit estimates, which mostly stems from different growth assumptions—because small tweaks to underlying economic parameters can swing the cost projections dramatically.

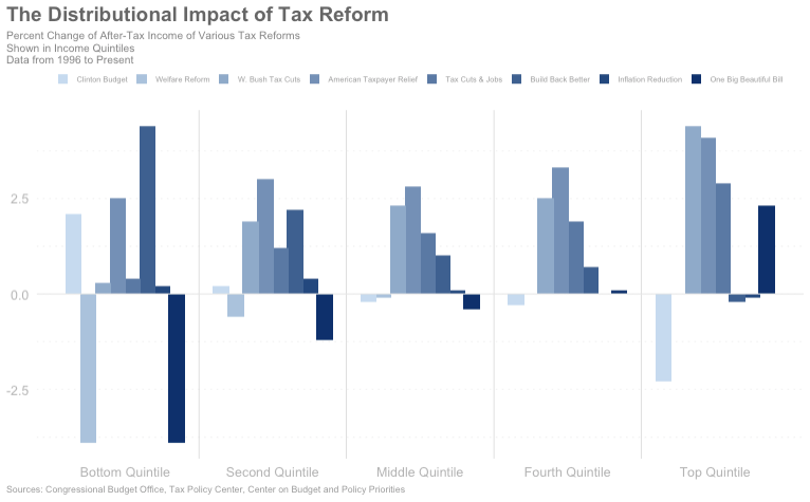

Congressional Republicans have advanced a tax bill to the U.S. Senate, analysis by the Congressional Budget Office would rank as the most regressive tax reform in decades, at a time when the overall economy seems fairly weak, internal congressional politics appear rather thin, and most Americans remain deeply concerned about an already regressive economy. Congressional cosponsors argue the bill informs long-run growth and reduces the deficit. As the Senate considers the One Big Beautiful Bill, widely criticized by economists as legislation that would disproportionately benefit upper-incomes at the expense of low and moderate income families. The Senate Republican majority remains tentative, with H.R. 1 advancing under budget-reconciliation rules, the bill can pass with a simple majority, with very little room for dissent.

Supporters argue that H.R. 1 increases long-run GDP and recoups significant static cost, delivers a marginal after-tax income bump to every quintile in the first two years, raising real wages through a lower corporate rate, spurs small-business investment via full expensing, and leaves debt-to-GDP slightly below the current-law path thanks to growth and back-loaded offsets. Opponents argue the bill would increase the deficit and shift the tax burden to moderate income households, proponents argue that the legislation would lower the deficit by reducing wasteful spending, that disagreement largely centers on different growth projections. While supporters and critics agree on the upfront cost of the bill, the numerical disagreement regarding the deficit relies on opposing GDP-growth assumptions, which leads supporters to project a deficit drop and opponents to predict a deficit increase.

The One Big Beautiful Bill has a target date of July 4th for a floor vote, though ongoing negotiations make the exact date unclear. With no Byrd-rule ruling yet, H.R. 1 remains a reconciliation bill needing only a simple majority to pass, though any part the Parliamentarian later flags as extraneous must be dropped or win a 60-vote waiver. Assuming the bill is advanced in its present form, with the current senate composition of 53-47, Republicans can only afford to lose 4 votes which may be tenuous considering that some members have already voiced concern, to pass leadership must satisfy both moderates and fiscal conservatives.

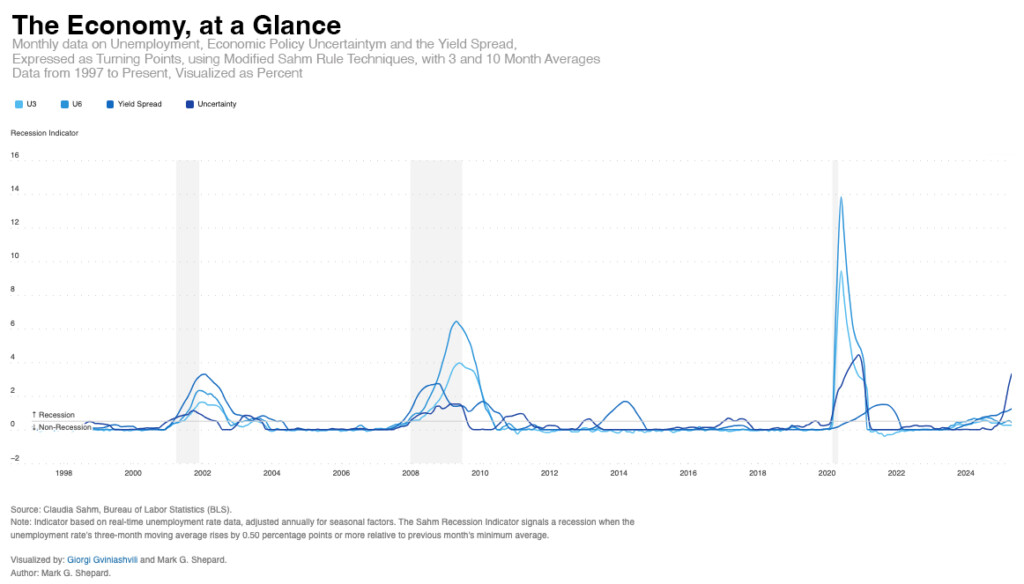

Following another month of somewhat negligible jobs data the Business Cycle Dating committee at the National Bureau of Economic Research, the group tasked with designating a recession, has not scheduled a formal meeting, which signals a cautionary reading of any potential downturn. Recent jobs data have delayed any official recessionary designations. While Americans still rank economic issues as the most important policy priority, survey data shows that most households have long concluded the economy is “bad.”

Long-running structural problems—stagnant real wages for most workers, regionally uneven job growth, and widening household-wealth gaps—have left millions to conclude that the benefits of any expansion never reached moderate-income households. Those weaknesses are visible in under-employment data, the U-6 rate, and in the stubbornly low labor-force participation of prime-age men, both of which remain well below pre-pandemic peaks. Even with headline unemployment flat, those deeper measures suggest slack that traditional indicators can miss—yet they are precisely the conditions economic stabilizers should target.

In terms of policy, H.R. 1 moves in the opposite direction. Non-partisan analyses show the largest permanent tax reductions in the One Big Beautiful Bill accrue to the top quintile, while many low-income households see either marginal gains or, after temporary credits expire, net tax increases. Because the plan, in order to remain roughly budget neutral, also pares back Medicaid and trims refundable credits tied to work hours, the legislation risks tightening the very household budgets that first register downturns when hours are cut. In short, the distributional tilt of the legislation intersects uncomfortably with the labor-market asymmetries that research identifies as early-warning signals.

Turning-point analysis shows mounting uncertainty, under-employment rising and the yield curve deteriorating, even as the headline jobless rate stays low. Fiscal capacity is not the only concern; policy timing matters too. With forward-looking GDP and sentiment gauges drifting down and inflation expectations edging up, most forecasters recommend a neutral or mildly counter-cyclical stance—keeping dollars in the hands of consumers most likely to spend them. A regressive cut financed by deficit expansion offers limited near-term demand support while increasing long-term rollover risk; it may also leave Congress with less room to act if a recession materializes, because the easiest revenue levers will already have been pulled.

Taken together, the bill neither addresses the chronic fragilities in the labor market nor builds the automatic stabilizers that could cushion the next shock, right as researchers have become concerned about a downturn. The legislation might satisfy a political preference for lower top-line tax rates on upper-incomes, but the bill does so by exposing the economy’s still-vulnerable middle and lower tiers to greater volatility. Given the Senate’s paper-thin margin and the country’s equally thin patience for policies perceived as one-sided, the question is no longer whether H.R. 1 can pass, but whether it meaningfully advances the mandate voters set: an economy that feels fair, resilient, and broadly shared. Whether the bill meets voter expectations for a fair and resilient economy could hinge on how these competing forecasts play out.