Gillian Fuchs and James Orr

January 31, 2024

Nearly four years after the onset of Covid-19 how is employment in New York City faring? In this post we outline the pattern of recovery of employment in the City and show how employment in different industries is evolving. Employment has just about reached its pre-pandemic level. Leading the rebound has been the recovery of jobs in several established sources of growth including Professional and Business services and Healthcare, along with Finance. Job growth is still uneven, however, and the effects of the pandemic and the efforts to contain it linger, particularly in the city’s retail trade sector, where job weakness reflects the incomplete return to the city of office workers and tourists. The job recovery has also helped to push unemployment down to its pre-pandemic rate, although the city’s labor force, like the population, is now smaller. While our focus is on the city’s employment recovery from the pandemic, we also discuss the recent growth in asylum seekers in the city which is adding a new post-pandemic dimension to the fiscal outlook.

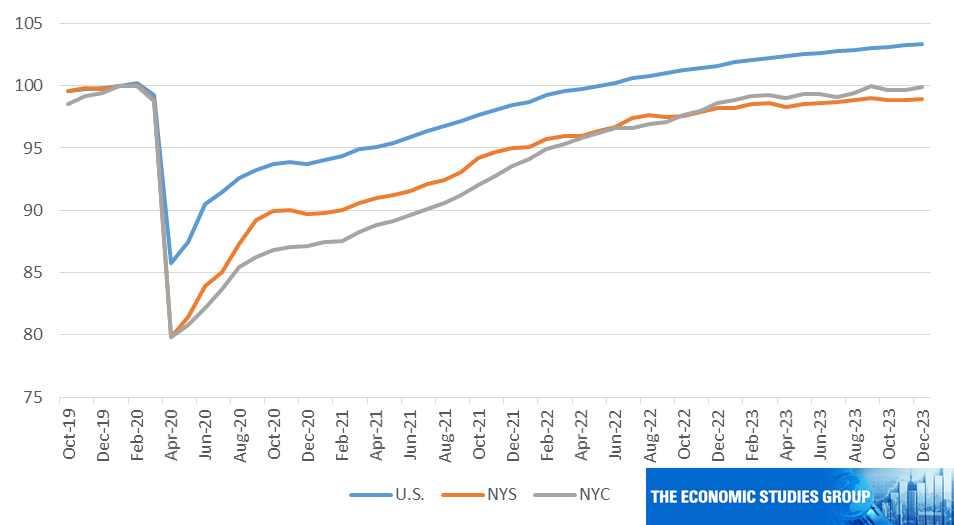

Downturn and Recovery in the Nation, New York State and New York City

The Covid-19 related job losses took place in the the space of several months in early 2020. New York City lost over 900,000 jobs, or about 20 % of its employment, and the state lost an equal share. As the epicenter of the virus the employment declines were significantly more severe than those of the nation. Figure 1 below traces out the downturn and recovery of employment and shows that the phases of the recovery in both the city and state mirror the nation: The initial sharp decline bottomed out in April 2020, turned around sharply and was followed by a fairly steady job growth through mid-2022, supported by a highly stimulative set of monetary and fiscal policies. The recovery then continued though at a slower pace since then, correlating with the shift to the higher interest rate environment. As of December of this year the city is just several thousand jobs short of its pre-pandemic peak. Given the depth of the downturn in the city, and also the devastating effect the virus had on the population, a return to the pre-pandemic level of employment is a milestone.

Figure 1. Total Employment: U.S., New York State and New York City

Note: January 2020= 100

Source: U.S. Bureau of Labor Statistics

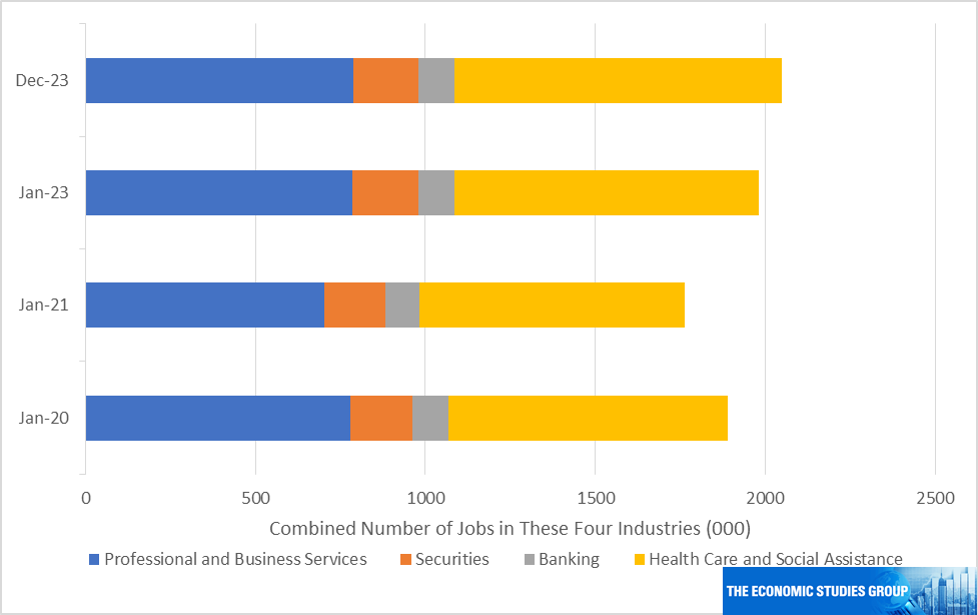

The recovery of employment in the city has been led by several key industries: professional and business services, banking and securities, and healthcare. Together these industries employ over 2 million workers, about 45 % of all city jobs.

Figure 2. Total Employment in Selected Industries in New York City

Source: New York City Office of Management and Budget

The sharp downturn evident in total employment was not seen in these industries in large part because, except for healthcare, many of these workers had the option of continuing their employment from home or other remote location. During 2023, growth in professional and business services and banking and securities jobs was flat. However, the stability of the securities industry, or Wall Street, was crucial for the city due to its outsized contribution to activity, with more that 20 % of total earnings in the city directly generated by this sector. Healthcare workers largely remained in the city to address the increased demand for services related to the pandemic.

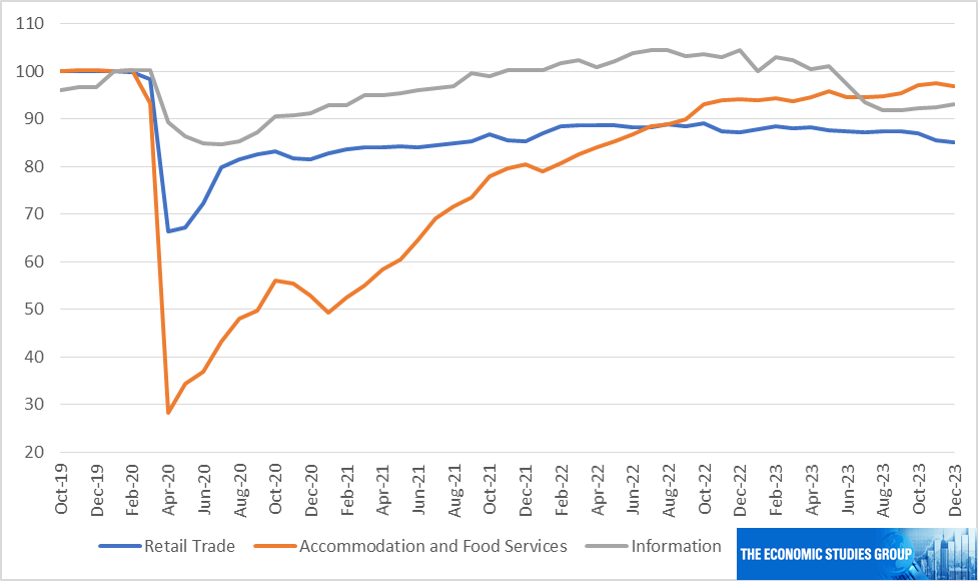

A more mixed picture is seen in the path of recovery of the accommodation and food service, retail trade and information industries reflecting both the impact of the pandemic and industry-specific developments.

Figure 3. Employment in Selected Industries in New York City

Note: January 2020= 100

Source: New York City Office of Management and Budget

Jobs in the accomodation and food service industry have roughly tracked those of the city as a whole but jobs in retail trade are still more than 10 % below their pre-pandemic peak. The lack of a full recovery in these industries, but particularly in retail trade, is associated with several lingering effects of the pandemic; namely, the loss of population, the decline in tourism and the fact that many office workers continue to work from home or a remote location. The chart below shows that the city’s population declined about 4% from April 2020 to 2021. A relatively large net out-migration of residents and slower net international in-migration were important factors. The decline in population was much more muted as of the last available data point, July 2022. Steep declines in tourists coming to the city and workers returning to their offices between 2020 and 2021 have been partially reversed, with tourism close to its previous level but office occupancy rates recovering more slowly.

Figure 4. Population, Tourism, and Office Occupancy in New York City

Sources: Population: https://bit.ly/423bozY

Tourism: https://bit.ly/426LRWr

Office occupancy: https://bit.ly/3StsjZn

Fewer residents, tourists and office workers in the city is bound to have an impact on spending and employment at the retail level where job counts are still down about 43,000. A recent report shows the number of national retail chain stores in the city down more than 1000 from its pre-pandemic level, linked to the reduction in the population and in the number of office workers coming into the city. Beyond the effects of Covid, however, the expansion of e-commerce had already been taking a toll on jobs in the sector. This changing consumer behavior has led to some restructurings and store closings and there is some uncertainty as to when jobs here will return to pre-pandemic levels.

The information industry includes firms engaged in traditional publishing activities, motion pictures and broadcasting, tech firms, including well-known companies such as Apple, Amazon, Google and Facebook, and a host of others engaged in activities such as app developing, data analysis and digital security. Employment in the industry passed its pre-pandemic peak in late-2021. However, growth paused starting in the second half of 2022 and job counts were back to their pre-pandemic level by May 2023. This mirrored a similar weakening nationally and was correlated with the rising interest rates. Tech firms are also major users of office space in the city and this weakening has affected the commercial office market. However, the city’s tech ecosystem, which includes factors such as availability of space, a skilled workforce and the ability of startup firms to attract venture capital, is still ranked second only to Silicon Valley. In New York, the recent sharp weakness in the sector reflects, in part, the strikes by writers over disputes with the motion picture and television producers from May to September and by the actors’ union from July through November.

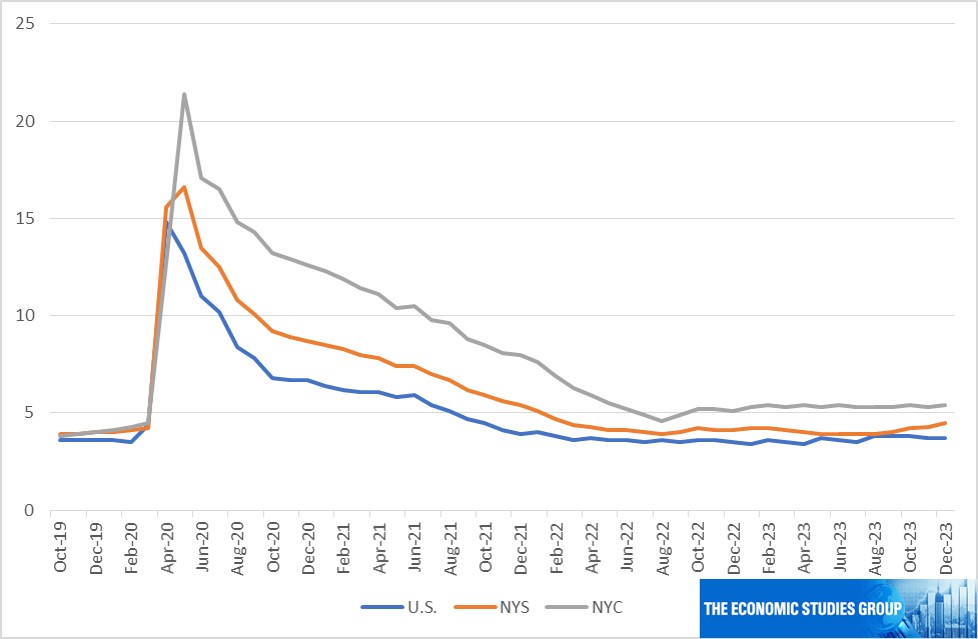

As jobs fell in New York State and New York City, the number of unemployed New Yorkers rose sharply, peaking at more than 20 % in the city and 16% in the state, before declining along with the nation. While they remain slightly above the national rate and their pre-pandemic rates, they mirror the nation in not rising to any significant degree with the tightening of monetary policy. For the city, however, consistent with the decline in the population, the work force is down about 3.0 % since the pandemic.

Figure 5: Unemployment rates in the U.S., New York State and New York City

Source: U.S. Bureau of Labor Statistics

Looking Ahead

While concerns remain about the pandemic-related decline in population and the rising but still low office occupancy rates, as the city enters 2024 some new developments are taking on importance. One is the macroeconomic environment. The city’s jobs recovery, like the nation’s, was supported by the highly stimulative fiscal and monetary policies introduced in 2020 and 2021 to combat the virus and the efforts to contain it. However, the anti-inflation tightening of monetary policy beginning in the spring of 2022 saw rates rise from zero to 5 % in the span of a year and the pace of recovery slowed. Recently inflation has been moderating and now the high interest rates are expected to begin to decline over the course of 2024. The movement to a lower interest rate environment would support jobs in several interest rate-sensitive sectors, including information technology, construction, and finance. Total employment in the city is currently projected to expand over the next several years, though a risk for the city’s recovery is that inflation does not get under control and restrictive monetary policies are re-introduced.

Locally, about 165,000 asylum seekers have received care from the city since the spring of 2022 and currently about 68,000 are receiving city-funded care. Expenditures are incurred across a number of agencies for food and shelter as well as for services such as administrative, legal and health. The recently-released City of New York Preliminary Budget for Fiscal Year 2025 estimates the costs in the current 2024 fiscal year and in 2025 will total about $9 billion, smaller than earlier projections though above some other cost scenarios. The smaller estimates reflect lower projected numbers of asylum seekers and cost savings in service provision. Higher than expected tax revenues and a larger contribution from the state are projected to further limit the fiscal impact. Any significant unexpected increases in asylum seeker-related costs or declines in revenues remains a risk to the city’s fiscal situation.