March 28, 2023

On March 10, 2023 the American banking system suffered the second biggest bank collapse in its history. How did this happen? In this post we examine the reasons behind the collapse of Silicon Valley Bank (SVB), which caused tremendous jitters in the financial markets and forced the authorities to step up to prevent a contagion effect and restore confidence. We examine the bank’s investment decisions and show how interest rate hikes can expose an institution to adverse shifts, particularly those like SVB that have used its deposits to invest heavily in long term assets with long durations.

Bank failure is defined as the situation when an institution is unable to meet its obligations to the depositors or/and creditors. Since 2000, 543 US- based banks failed, with more than half occurring during the Great Recession period alone. Although stricter regulation made failures rarer after the Great Recession, SVB, a California based bank with more than $200 billion in assets collapsed after a “bank run” triggered by fears of insolvency. A bank failure creates turmoil in the financial markets and could have a profound impact on the soundness of the banking system as a whole and the real economy.

Traditionally banks act as intermediaries taking short-term deposits from the so-called surplus agents, at relatively low interest rates, and provide/transfer capital (in the form of loans or bonds) to agents in deficit, at relatively higher interest rates, to meet their long term financing needs. This maturity transformation, called maturity mismatch, means that assets have longer duration (or maturity) than liabilities, and therefore are less liquid. For banks an excessive maturity mismatch is desirable-especially when the yield curve is positively sloped and longer-term interest rates are well above short-term rates-because it increases profitability. But for the financial system, maturity transformation is undesirable because it could create a liquidity crisis threatening the existence of the bank and undermine the confidence in the banking system. Although interest rate risk is intrinsic to the process of maturity transformation, borrowing short term and lending long-term, banks have the ability to hedge the risk by using interest rate derivative instruments, like interest rate swaps.

Weakened Regulatory Environment, Lax Supervision and Governance

After the 2008 global financial crisis, the authorities passed a tough financial reform, “Dodd-Frank Wall Street Reform and Consumer Protection Act”. However in 2018, the government rolled back the regulations and exempted banks with assets less than $250 billion from some of the rules of the Dodd-Frank Act. Nevertheless, even with this, it’s at the FED’s discretion to apply enhanced prudential supervision-including how frequently to conduct required supervisory stress tests-to banks with at least $100 billion in assets. On that ground, SVB was not required to comply with certain reporting, disclosure or to keep as high a liquidity coverage ratio as banks with over $ 250 billion of assets (this ratio is the proportion of highly liquid assets held by banks to ensure their ongoing ability to meet short-term obligations, enough to fund cash outflows for 30 days).

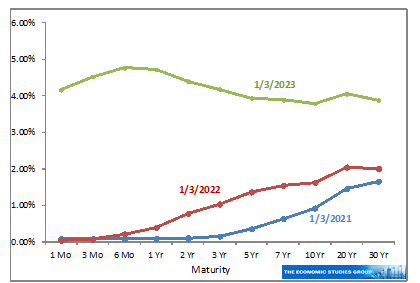

The cycle of interest rate hikes and the impact to bonds’ prices

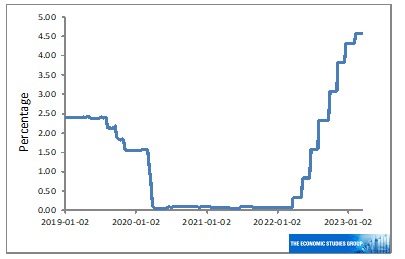

In early 2022 the FED reacted to the mounting inflationary pressures and started tightening monetary policy by raising the Federal Funds policy rate. From interest rates being essentially zero during the pandemic, referred to as the zero lower bound, the policy rate has rapidly crested at 5.0% within one year (graph 1). Although this is the conventional way to combat inflation, a sharp increase in the interest rates could also adversely impact banks’ balance sheets and pressure the soundness of the banking system. Increasing interest rates erode the value of long-term bonds much more than the value of short-term securities, especially the ones bought when interest rates were close to zero and bonds prices higher. Consequently when interest rates rise the price of these bonds decline and create a balance sheet problem for the banks.

Graph 1. The Federal Funds Rate

Source: Fred, Federal Reserve Bank of St. Louis

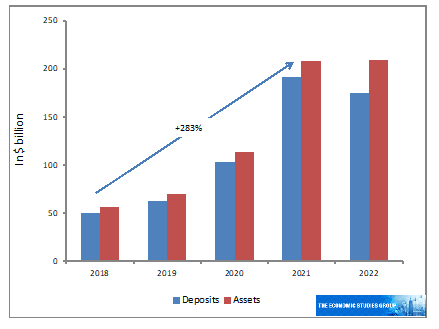

A massive expansion of “hot money” deposits and investments in long-term securities

The year 2021 saw the raising of enormous capital for start-ups through Venture Capital firms. During the last four years, deposits in SVB increased dramatically from $50 billion in 2018 to almost 191 billion in 2021, before declining to 176 billion at end of 2022 (graph 2). This led to a threefold expansion in its total assets from $56 billion to $210 billion. The deposit growth rate was about 280%, compared with 30% for all the insured banks. SVB was flooded with deposits, primarily from start-up and tech companies concentrating in a unique client/deposit base and mainly uninsured deposits, and thus exposing itself to concentration risk.

Graph 2. Deposits and Total Assets for SVB .

Source: Federal Financial Institutions Examination Council, Schedule RC-Balance Sheet

In addition to the huge unstable deposit base and the moderate demand for loans ($ 76 billion), totaling around $ 115 billion, search for greater return prompted the bank to invest the excess capital ($191 -$76) in long-term security investments rather than to place them in shorter-term instruments and/or in cash.

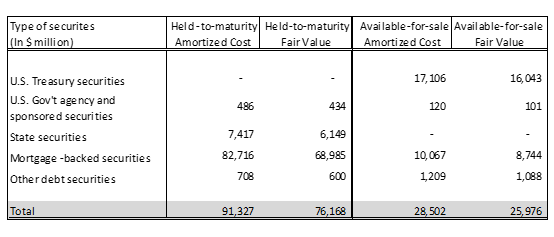

Based on the Consolidated Reports of Condition and Income, SVB invested mainly in longer-term, higher yielding government and government agency mortgage back securities, like Fannie Mae and Freddie Mac. Investments in securities are typically classified in the balance sheet, for accounting purposes, as a) held-to-maturity and b) available-for-sale. Based on the amortized cost method, in 2022, SVB had placed $91.3 billion under the first category and $28.5 billion in the second, totaling around $120 billion (table 1). But due to the interest rates hike, the fair value of the portfolio went down to $102 billion, causing a hefty unrealized loss of $18 billion at the end of 2022. Typically, the decline in value is not a major issue, unless due to liquidity problems the bank is forced to sell part of the portfolio. The unrealized loss would have been much lower if SVB had invested in shorter maturities, like into two-year notes or less, since longer-term securities are more sensitive and more exposed to rising interest rate.

Table 1. SVB Security holdings, Held-to-maturity and Available-for-sale, in Amortized Cost and Fair Value (end of 2022)

Source: Schedule RC-B-Securities. Consolidated Reports of Condition and Income-FFIEC 031

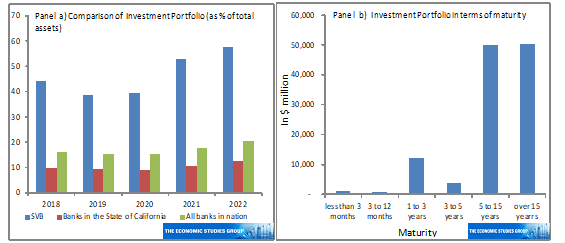

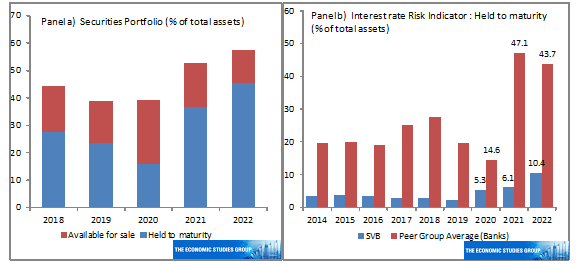

The combined value of securities held was overwhelmingly large in terms of total assets. From 39% in 2020, the ratio went up to 57% in 2022, well above the 13% average of the State of California banks and 20% of all banks in nation (graph 3, left panel). One could argue that SVB failed to hedge against risk by diversifying its investments portfolio, since more than 85% of the capital was invested in securities with maturity of greater than 5 years (right panel ).

Graph 3. Comparison of SVB’s Investment Portfolio with peer groups and maturity

Source: Federal Financial Institutions Examination Council, Schedule RC-Balance Sheet and Securities

Graph 4 illustrates the interest rate risk indicator for SVB and in comparison to the peer group average and shows that. SVB decided to increase the holdings of the held-to-maturity category since 2021, even though the FED, through the forward guidance tool, had informed the markets of the upcoming cycle of rising interest rates. The SVB management had the time to rebalance the assets portfolio (and the liabilities) and to hedge against the interest rate risk. Nevertheless, according to the consolidated report, the management decided to continue its policy, while setting the risk indicator index between four and eightfold times higher than the peer group average (panel b).

Graph 4. The composition of SVB’s Investment Portfolio and comparison with peer group.

Source: Federal Financial Institutions Examination Council, Schedule RC-Balance Sheet

The impact of higher interest rates, adverse market conditions and the Bank Run

The rapid rise in the Federal Funds rate (graph 1) led to a sharply-inverted yield curve and the risks faced by SVB became a reality. As graph 5 shows, long-term interest rates were above short-term rates as recently as a year ago but have now moved below short-term rates.

Graph 5. Changes in the Yield Curve

Source: U.S. Department of the Treasury

Associated with the rise in interest rate was a weakening of the economic environment and as market conditions worsened and firms-mainly start-ups- required more working capital (cash), deposit withdrawals escalated. The excessive and increasing reliance on these “hot money” type of deposits, in the absence of other long-term funding sources and a means of keeping deposits intact, like a revolving credit line facility, formed a potentially fragile and insolvent bank environment. And informed depositors are more likely to run away with the first sign of trouble. In an attempt to meet depositors’ claims for cash, and improve the bank’s liquidity profile, SVB was forced to sell $21 billion from the $26 billion of its available-for-sale securities portfolio, and, given the inversion of the yield curve, it had to incur a vast loss of $2 billion. Following this sale and to strengthen its balance sheet, SVB announced an unsuccessful sale of $2.25 billion worth of stock shares ($1.25 billion of common stock to the public, $0.5 billion to the General Atlantic firm, and $0.5 billion from a convertible preferred stock offering). The sequence of these events triggered one of the biggest runs in history, with more depositors racing to withdraw their capital. The run heralded SVB’s failure: as the value of the stock plunged and after trading was halted, regulators placed the bank under receivership and created a bridge bank transferring all insured deposits.

In conclusion, the Basel Committee emphasizes the problems with excessive liquidity risk and maturity transformation. While most of the investments were in longer term securities, for the purpose of increased profitability SVB failed to adjust the duration gap between assets and liabilities before the beginning of the sharp interest rate hikes. In addition, and equally importantly, in an adverse economic environment, the unstable and non-diversified deposits base, together with the lax regulatory supervision created the grounds that drove SVB’s demise.