by Maryam Fatemi and James Orr

Maryam Fatemi and James Orr

September 7, 2022

Overall employment in New York City has not fully recovered from the huge shock it took following the Covid-19 outbreak in early 2020. But looking across industries, both the depth of the downturn and pace of recovery has been uneven. In this post we examine how key industries in the city are faring, from those that were hard hit by the pandemic and still see significant shortfalls to those where job counts now match or exceed their pre-pandemic peaks. We then take a closer look at the performance of the city’s tech sector and the components that have helped jobs there hold up particularly well throughout the pandemic.

The Jobs Recovery to Date

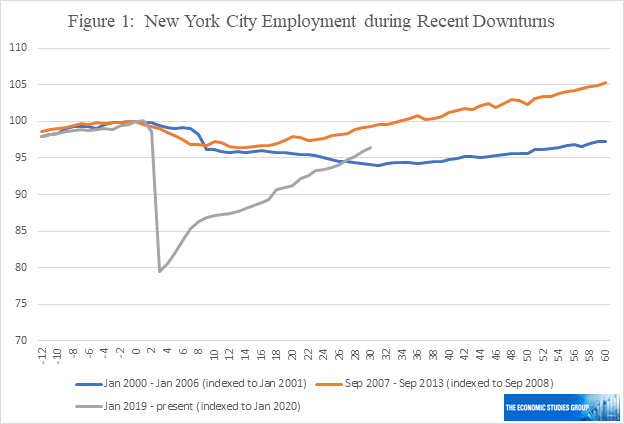

The downturn in employment in New York City at the start of the pandemic is significantly deeper than in either of the city’s previous downturns. The monthly index of employment in the figure below, which looks one year before and up to five years after each peak, shows the 20 percent initial decline in employment was unmatched even at the worst of the downturn in the early 2000s and in the downturn that began in 2008 with the financial crisis. The unemployment rate in May of 2020 reached 21 percent, double the highest rate in either of the previous cycles.

Source: U.S. Bureau of Labor Statistics

The nature and depth of each downturn is different, and recovery patterns are influenced by many factors. For example, the shock of the 9/11 terrorist attack on New York City was preceded by the end of the dot.com boom and followed by a national recession. In the current recovery health concerns are playing a unique role and the recently elevated levels of new cases is a reminder that risks remain. Thankfully, the rise has not lead to significantly more hospitalizations and deaths.

Assuming health conditions do not worsen, the recovery of jobs will reflect both a return to pre-pandemic activity as well as the changes brought about by the pandemic. In particular, it is important for many industries, particularly those in retail and recreation activities, to get residents, commuters and office workers, and tourists back into the city. There is some evidence that the declines seen at the start of the pandemic are being reversed. The city’s population fell about 330,000 (4%) from April 2020 to mid-2021 as residents left the city, immigration slowed, and there were fewer births and higher deaths; since then, each of these components of population change is returning to its pre-pandemic pattern. For many commuters, the broadening of work-at-home options meant not having to be in the city. A recent survey of firms in Manhattan indicates workers are returning to their offices, but a hybrid model of less than a full workweek in the office may become permanent. The decline in tourists in 2020 and into 2021 reduced activity in hotels and restaurants, but domestic and international tourism to the city is projected to rebound this year and next. Each of these trends should support a return to normalcy in the city and a continuation of the jobs recovery.

Industry Recovery Patterns

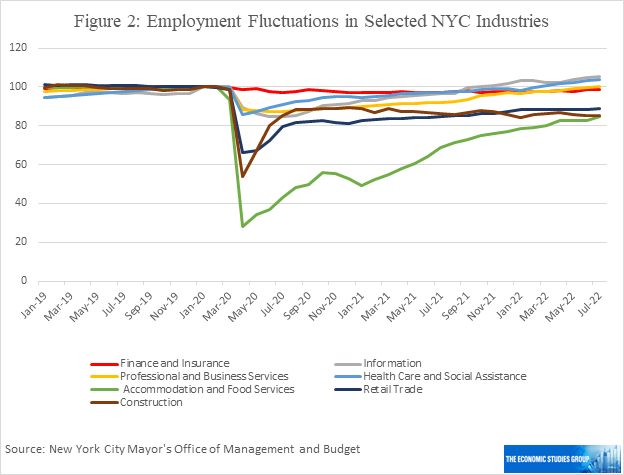

Compared to pre-pandemic peaks, shortfalls remain in the hard-hit accommodation and food service, retail trade and construction industries. Two industries, finance and insurance and professional and business services, have matched their pre-pandemic peaks. These were not hit as hard because many employees had options to work from home and the demand for their services continued. In fact, Wall Street profits since the pandemic have been at record highs.

Employment in the healthcare and social assistance industry and the information industry have now surpassed their pre-pandemic peaks. Healthcare is one of the city’s largest industries and appears to have re-established its pre-pandemic expansionary trend. Notably, the life sciences sector is continuing to expand and it supports several industries in and outside of healthcare through its research and development in biotechnology and medicine, its many medical and diagnostic testing laboratories and its production of pharmaceuticals and medicines.

New York City’s Tech Sector

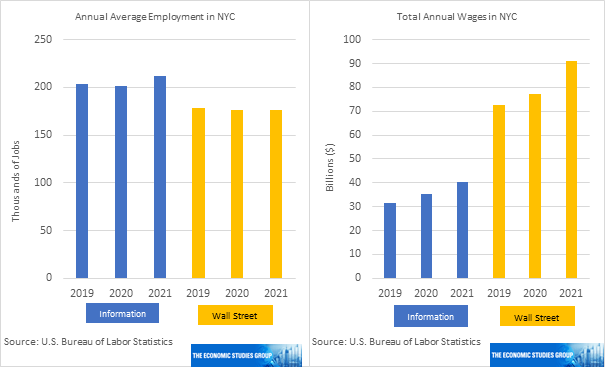

The strength of tech employment in the city throughout the pandemic is noteworthy and we want to take a deeper look what we mean by the tech industry. The information industry (2017 North American Industry Classification System code 51) is typically used to represent the tech sector which, as noted in an earlier city jobs update, now employs as many workers in the city as Wall Street (code 523). Recently released data show that employment and wages held up in both industries during the pandemic, with Wall Street wages rising significantly and maintaining its more than 20 percent share of all wages paid in the city.

Figure 3: Information Industry and Wall Street Employment and Wages, 2019-2021

The information industry captures firms that are involved in some way with the production and distribution of information as part of their core business. The content is typically intangible and products include news, websites, software programs, web search portals, and wireless telecommunications. The distribution of the information takes many forms including newspapers, theaters and on-line. Household names include Google, Microsoft, Facebook and Yelp, but there are a huge number of startups and other perhaps less well-known firms that make up the sector. Although we use this definition of tech, the reality is that the application of technology has permeated the activities of workers and businesses to such a large extent that it is hard to think of jobs that do not have at least some tech component.

The list of products and distribution activities in this sector is long and growing. We look first at employment and wages in the publishing sector (511), which excludes internet publishing. Here are the publishing and broadcasting companies, both the more traditional news and entertainment ones as well as more specialized broadcasting outlets. Included are software publishers, the firms that design, document, install and support computer programs for general use by consumers and businesses. One could think of Microsoft and Adobe as being in this category as well as firms producing tax computation software. A second category is internet publishing (51913) which includes firms publishing or broadcasting content on the internet. Netflix would be an example. The sector includes web search portals providing access to news and information and enabling users to socially network for example Facebook and Twitter. The chart below shows employment and wages paid in both components in the city expanded from 2019-2021.

Figure 4: Publishing Industry Employment and Wages, 2019-2021

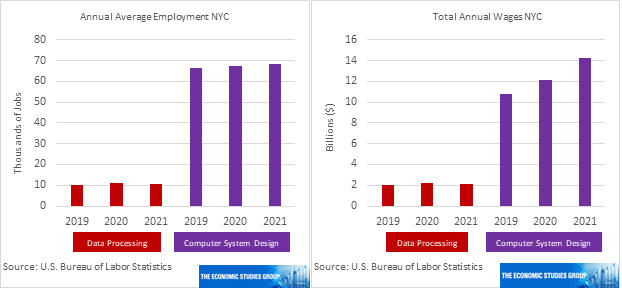

Another sub-category of the information industry we label as data processing (518) which includes firms that provide services such as computer time-share on mainframes, scanning data, and storing large amounts of data, and can be thought of as services that might be needed by small businesses. Both employment and wages were steady over the period, though it pays a healthy $2 billion in wages annually. Firms providing customized computer services for individual companies, something like “tech solutions” which we label computer systems design. This sector (5415) is not part of the information industry but we consider these closely-related activities. The customization includes the design of a company’s computer system and the writing, installing and maintaining of that software and differentiates it from the firms producing computer software for more general use included in internet publishing. Employment in the sector increased marginally but wages rose by about 30 percent to $14 billion.

Figure 5: Data Processing and Computer System Design Employment and Wages, 2019-2021

The graphs show the range of activities in the city’s tech sector and the importance of the internet publishing component in its growth in terms of jobs and especially wages. Further support for continued growth of the sector in the city is seen in a set of innovation indicators that show record levels of venture capital funding for city tech firms last year. Looking ahead, recent layoff announcements by tech firms in the city and nationwide may point to some slowing in the pace of expansion. Also, the pandemic led to worker concerns about location, lifestyle and remote working and there was some indication that the major hubs, such as New York and San Francisco, would lose out to smaller hubs. Our look at the data found no loss of the city’s share of national employment or wages during the pandemic.

For the city overall, jobs stand at roughly 4 percent below their pre-pandemic peak. At growth rates seen prior to the pandemic, the city’s pre-pandemic employment peak would be reached sometime in 2024; any sustained pickup in growth would pull this forward. However, rising interest rates are a potential drag. The Fed continues its fight against high inflation and interest rate sensitive sectors, such as construction and housing, and the strengthening dollar could slow growth in exports and tourism. Furthermore, the fight against inflation in many European countries and the slowing in growth in China will further weaken demand. As in past cycles, any national weakness will feed back on the city and slow the recovery.