Hengzhong Liu

June 18, 2022

This article argues that the current wave of deglobalization will not stop China from surpassing the United States as the largest economy in the next decade, but it will prevent China from becoming the No. 1 economic power in the foreseeable future because economic size does not necessarily translate to economic power. This is because the economic power of a country depends not only on the size but also on the “quality” of its GDP mainly determined by the level of technology.

The dominance of a country’s economy depends not only on the size of its GDP, but also on many other factors. For example, GDP per capita or median income, the high-tech content of its goods and services, the resilience of the economy in crisis events, the degree to which other countries depend on its exports, and how much other countries wish to hold its currency as reserves. For ease of reference, we assume that all of these factors make up the concept “GDP quality” or “economic strength” that is specifically introduced in this article.

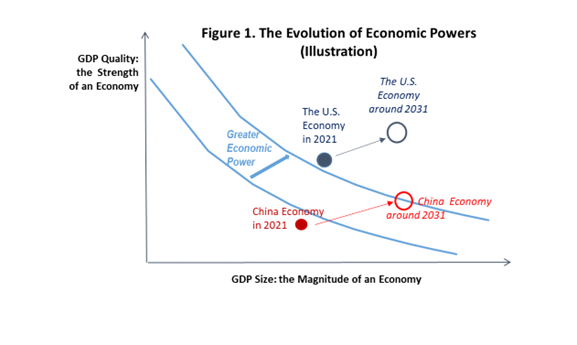

Taking GDP size as the magnitude of an economy and GDP “quality” as the strength of an economy, how do these two aspects interact to form the economic power of a country?, The curves in Figure 1 illustrate this relation. Given the size of a country’s GDP, the higher the quality of its GDP, the greater is its economic power. Symmetrically, given the quality of a country’s GDP, the larger the size of its GDP, the greater is its economic power.

The combination of all GDP scale and quality on the same curve represents the same level of economic power, and can be called an “equal economic power curve”. That is, on the same curve, a smaller GDP with a higher economic strength has the same level of economic power as a larger GDP with a lower economic strength. In other words, greater economic size does not necessarily mean greater economic power.

II. Global decoupling won’t stop China from becoming the world’s largest economy in the next decade

After more than 30 years of globalization, China has become the world’s second largest economy and gained significant momentum over the U.S. economy. In recent years, however, globalization has faced a dramatic and often hostile backlash, especially against China, due to protectionist policies and nationalist movements around the world and the COVID-19 pandemic crisis. These factors raise legitimate doubts about whether China will avoid the so-called middle-income trap (e.g. remaining at the same middle level of income) and overtake the U.S. as the largest economy, as most previously believed.

Undoubtedly, as the current headwinds of globalization persist, advanced economies will see less trade and investment with China whose exports and investment in them will decrease accordingly. This presents significant challenges to the growth that China needs to catch up with the United States.

However, the economy of 1.4 billion people is still developing, and the per capita GDP is not even 20% of that of the United States. Moreover, unlike 40 years ago when China began to “reform and open up”, the current economic system, technology and talent, and saving rate make China’s sustained growth momentum unstoppable. But, to ensure that China’s economy almost doubles in the next ten years, there needs to be enough market demand, enough advanced technology and talent, and enough investment sources. Let us discuss them one by one.

1) Even without developed country markets, China’s own domestic market is sufficient to support its catch-up growth.

We are talking about a market of 1.4 billion people, almost twice the size of the entire developed world today. Yet what matters is not just size, but the characteristics of this huge economy.

First, the population of leading regions such as the Pan Pearl River Delta region including Hong Kong, the Pan Yangtze River Delta region, and Bohai Bay region exceeds 200 million. The per capita GDP in these regions has reached $20,000-$30,000, which is close to the threshold of $30,000 for developed economies. These regions can set a good example at home and lead the rest of the country.

Secondly, the per capita income gap between the eastern coastal areas and other regions is 1.5-2 times, and the gap between urban and rural areas is 2.5-3 times. With more than 500 million rural population and more than 8 million in the mid and west regions, further urbanization alone has the potential to double the Chinese economy.

2) Even without further importing top-notch technology from advanced economies, China’s existing technology and talent are sufficient for overcoming the middle-income trap.

Note that to surpass the size of the U.S. GDP, China only needs to reach 40%-50% of developed levels in most economic sectors and indicators or only needs to reach ¼ of the U.S. GDP per capita. To this end, a state-of-the-art technology is not an absolute requirement.

Specifically, China’s continued urbanization mainly includes housing improvements, rural roads construction, irrigation and water supply systems building, agricultural modernization, expansion of the health and medical sector, increases in domestic vehicles and improvements to public facilities. Obviously, these jobs do not absolutely require the latest technologies, and the technology and talent China currently has should be good enough.

3) It is reasonable to assume that China will have sufficient resources to continue increasing investment in both the public and private sectors to drive further urbanization and growth.

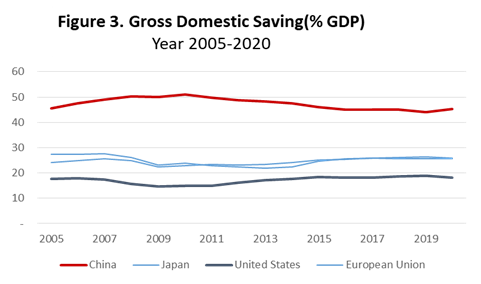

Over the past 30-40 years, investment from developed countries has undoubtedly helped China’s economy take off. Meanwhile, as Figure 3 shows, China’s saving rate has been almost double that of developed countries. In addition, a number of economic reform measures, such as bringing the then state-owned housing to the market, also stimulated a large amount of private investment.

source: https://data.worldbank.org.cn/indicator/NY.GDS.TOTL.ZS

III. China is unlikely to become the number one economic power in the foreseeable future

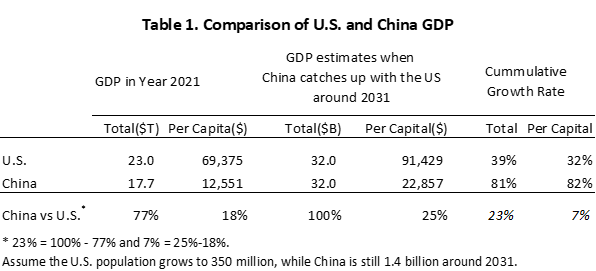

If we measure economic strength in terms of GDP per capita, then as Table 1 below shows, China’s economic strength is only 1/4 that of the United States, even though its GDP has grown to a size comparable to that of the U.S. That is to say, as shown in Figure 1, even if China were to become the largest economy one day (indicated by the red circle), its economic power would still be very low compared to the United States (indicated by the blue circle), which would still be the No. 1 superpower.

Source: GDP in local currency: https://data.imf.org/regular.aspx?key=63122827

Conversion of Chinese Yuan to USD for 2021 GDP: http://www.gov.cn/xinwen/2022-01/17/content_5668815.htm.

The share and composition of a country’s exports, or more precisely other countries’ demand for its goods, can also be used as a measure of its economic strength. For ease of discussion, let’s break down exports into three categories: geography-based products such as food, energy and element minerals, manufactured goods, and advanced technology.

Obviously, the export of advanced technology has the highest economic strength, because due to patents and technical barriers, truly advanced technology can only be provided by one or few countries for a long time, and most countries need it to promote economic development. Geography-based products have the second highest economic strength because they are only produced in certain places, and in some cases food and energy exports even have decisive power. The exports of manufactured goods have the weakest economic strength because they can always be produced elsewhere at similar or even lower costs.

What does America offer the rest of the world? Geography-based agricultural products and advanced technology, and now possibly natural oil and gas. What does China export the most? Manufactured goods. So obviously, in this regard, although China has become the largest trading partner of most countries, its economic strength is indeed relatively weak.

Constrained by land and population, China will not be able to export food and natural energy, at least in the near future. The only way for China to surpass the United States in economic strength is to drive technological innovation.

However, the general consensus is that China’s basic technology in most fields such as aero-engines, microchips, and system software lags behind the United States by about 20 years, and that China’s current system, while potentially effective in organizing mass production, does not best foster innovation and invention that often requires free competition and diverse approaches. In addition, continued global decoupling makes it harder for China to obtain the latest technologies from developed countries. Taken together, unless China makes its system more lucrative for technology advancements, these headwinds will keep China from catching up with the United States in technology for a quite long time, perhaps at least several decades.