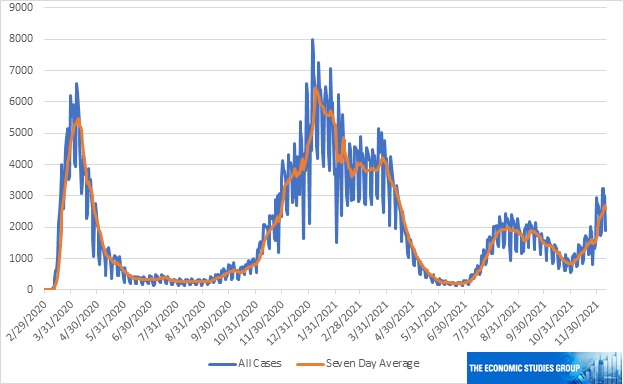

Trends in COVID-19 Cases in New York City

The figure below plots the daily new COVID-19 cases in New York City and the seven day average of new cases, beginning with the severe outbreak in March 2020 when the virus was becoming a driving force in the city’s economy. The decline in new cases in that summer was followed by a resurgence later in the year and into 2021. Then, as that wave appeared to be settling down mid-year, cases began to rise again associated with the Delta variant. Looking over the past year, the generally lower average number of new cases corresponds to the substantial increase in vaccinations—currently almost 80% of all residents in the city have received at least one dose of the vaccine. The most recent increase in new cases has not been on the same scale as the earlier two episodes, though the data show hospitalizations are increasing modestly. Deaths due to the virus are not rising though, unfortunately, the virus to date has resulted in over 34,000 deaths across the city.

Figure 1. New York City COVID-19 cases: Daily cases and seven-day-average

Source: nyc.gov

New York’s Labor Market

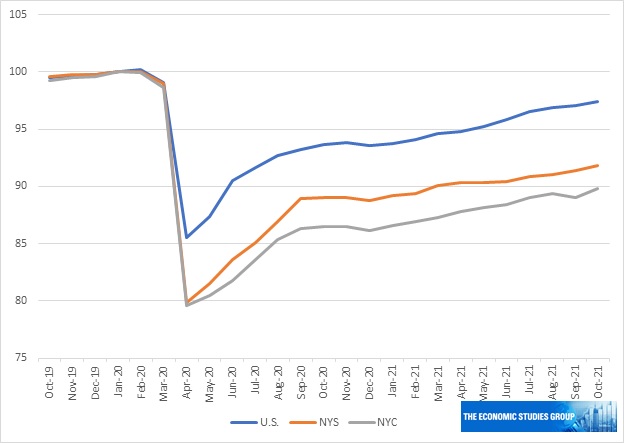

The figure below uses a monthly index to track the downturn and recovery of employment in the nation and in the New York State and New York City (NYC) from the pre-pandemic period to the present. The 20 percent decline in jobs in the first few months of the pandemic in both the state and city was unprecedented and exceeded the 14 percent decline nationwide. These employment patterns to a large extent mirror new COVID-19 cases, in particular the weakness in the recovery in late 2020 and early 2021 as cases resurged.

Figure 2. Total employment: U.S., New York State and New York City

Note: January 2001 = 100

Source: U.S. Bureau of Labor Statistics

The recent picture is one of an ongoing but somewhat bumpy recovery. Job counts continue to grow though, relative to pre-pandemic peaks, employment levels in October were still down about 8 percent in New York State and 10 percent in New York City. These percentages translate into shortfalls of about 800,000 jobs across the state and about 475,000 in the city. The recovery nationally has been on a slightly higher trajectory but still pre-pandemic levels have not been regained.

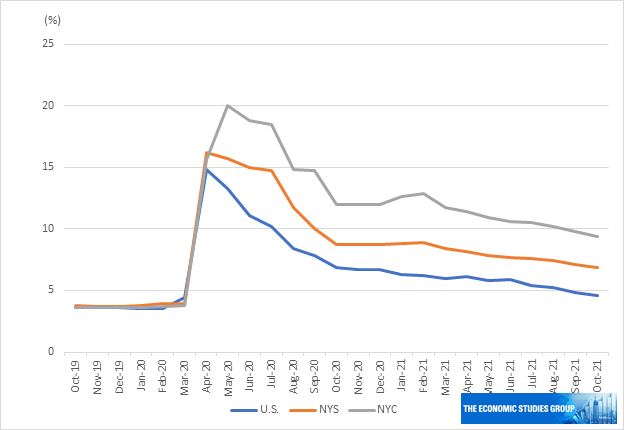

As jobs fell in New York State and New York City, the number of unemployed New Yorkers rose sharply. In New York City, the unemployment rate peaked at 20 percent last May before trending down; New York State’s rate rose to about 16 percent before trending down. Since then, rates remain on a generally declining trend and reflect the recovery in employment.

Figure 3. Unemployment Rate: U.S., New York State and New York City

Source: U.S. Bureau of Labor Statistics

Notably, the labor force participation rate in New York City, which had fallen sharply in the early months of the pandemic, has recovered to its pre-pandemic level; statewide, the rate did not fall as much as the city and is now about a half point below its pre-pandemic peak. Nationwide, labor force participation is still about 1.5 percentage points below its pre-pandemic peak, suggesting some places have a significant number of potential workers on the sidelines.

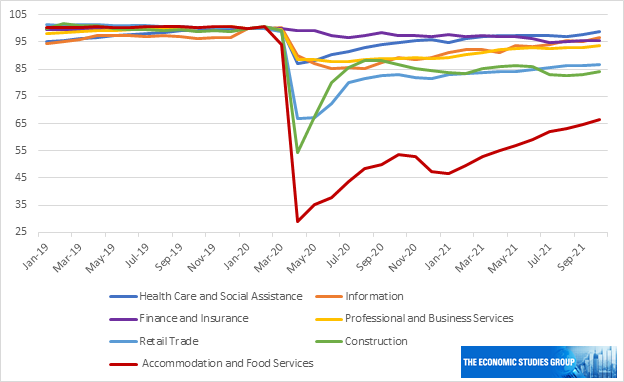

The pandemic had different impacts across industries with some having felt the brunt of the lockdown and restrictions on travel, tourism and shopping to a much greater degree than others. The figure below shows the varied pattern of decline and recovery of employment in seven industries in New York City. The more office-using industries such as Finance, Information, Professional and Business Services were not as affected as work-at-home options were relatively more easy to institute, and the recoveries there are continuing. At the other end are the hard-hit Accommodation and Food Service, Construction and Retail Trade industries where the recovery still has ground to make up.

Figure 4. Employment in Selected Industries in New York City

Note: January 2020 = 100

Source: New York City Office of Management and Budget

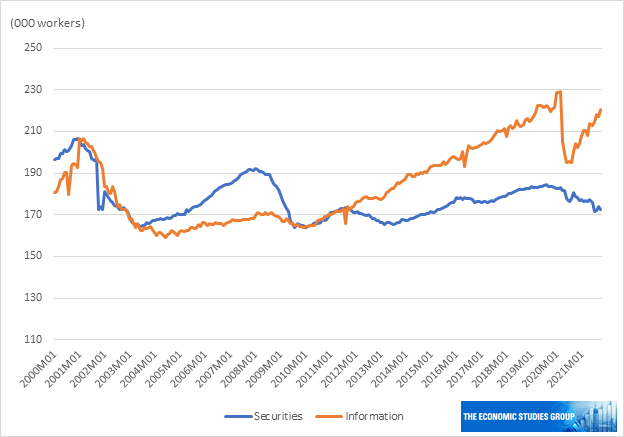

Looking in more detail at the city’s tech sector, measured by jobs in the Information industry, the longer-term steady increase in employment appears to be reasserting itself. This industry includes firms engaged in traditional publishing activities, well-known newer firms, such as Apple, Amazon, Google and Facebook, and a host other tech startups engaged in activities such as app developing, data analysis and digital security. The chart below shows jobs in the industry declining with bursting of the tech bubble in the early 2000s, followed by a steady rise to 230,000 at the outbreak of the pandemic. Even now employment is above its 2001 peak.

Figure 5. Employment in New York City’s Information and Securities Industries

Source: New York City Office of Management and Budget

One feature of this rise is that it has been accompanied by the expanded demand for office space. Despite concerns about the work-at-home option overtaking in-person office usage, tech firms are reportedly at the forefront of the purchase and lease of offices: in Manhattan, for example, both Amazon and Facebook are leasing large amounts of office space, and Google recently purchased the 1.7 million square foot space it was leasing near its existing offices. The size of the new spaces and the announced plans of these firms to increase employment suggest the new space is not simply for consolidation but for expansion. Evidently, these firms see an opportunity to obtain space and see workers in offices as a component of their future operations.

The expansion of jobs in the Information industry is also notable in that it has occurred at the same time as jobs in the securities component of the finance sector in the city, or Wall Street, have expanded more slowly and remain below their 2001 and 2008 peaks. The Finance sector, and particularly the securities industry, continues to play a significant role in generating income in the city, but a comparison suggests that tech firms are gradually becoming important sources of jobs; and these are on average good jobs with annual salaries over $200,000, well above the average of the private sector though still below average Wall Street salaries–$438,000.

Looking Ahead

The coronavirus remains a risk to the jobs recovery, particularly if the new Omicron variant leads to the types of individual, business and government responses that New York saw in the early stages of the pandemic. Apart from the virus, both monetary and fiscal policies will influence the path of recovery in the state and city, and the nation, during 2022. A downside risk is the lessening of support given to the economy by the Federal Reserve which has announced a gradually reduction in the size of its bond purchases which could over time adversely affect the more interest rate-sensitive sectors, such as housing, manufacturing and construction. The sizeable Federal fiscal support to combat the effects of the virus on individuals, businesses and local governments will be winding down though there will be some offset from the new Federal infrastructure bill. New York City is slated to receive roughly $100 billion over the next several years for improvements to the transportation and other infrastructure. The recovery will also be influenced by New York State’s new governor and the incoming mayor of New York City as they develop their economic initiatives and policies.