James Orr

April 29, 2019

The recovery and expansion of employment in New York City that began following the financial crisis and downturn continued into its ninth year in early 2019. This post examines recent overall job growth in the city and then looks at the variation in growth rates across industries and what this variation implies about the dynamics of the city’s job market. Recently-released employment data show jobs in the city grew 2.0 percent in the first quarter of 2019 over a year ago, modestly higher than in the same period in 2018 and in excess of the 1.7 percent nationwide growth. The last few years of the expansion, as noted in an earlier post, have seen a divergence in job growth among key sectors in the New York City economy, and this past year has continued that pattern.

Employment Trends in New York City, New York State and the Nation

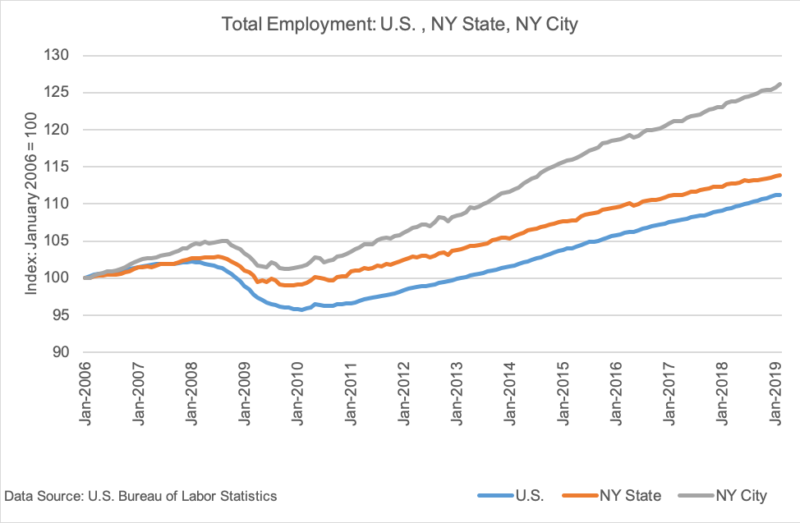

The figure below, also presented here, uses a monthly index of employment to show the robust recovery of employment in the city relative to both New York State and the nation. The level of employment in the city recovered relatively rapidly and is now almost twenty percent above its 2010 low. The recent growth rates, while off the highs of 2015 and 2016, nevertheless continue to run about 2.0 percent. Statewide, job growth has averaged closer to 1.2 percent over the past year, below the city and the national average growth of 1.7 percent. As has been discussed previously, this disparity in growth across areas in New York State has persisted for some time and reflects the relatively slower pace of employment growth in some of the metropolitan areas in upstate and western New York.

Performance of Key Industries in New York City

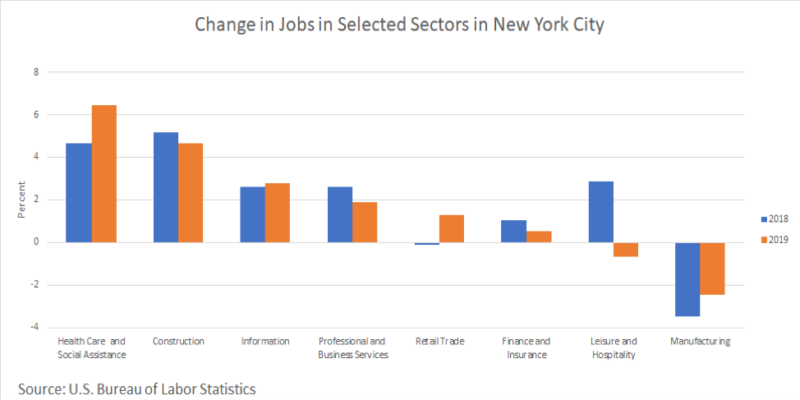

A look at the last two years of the expansion of employment in New York City shows some divergence in growth across sectors and years, a divergence which suggests the forces driving job growth in the city. Here we examine the variation in employment growth in eight sectors—Health Care and Social Assistance, Construction, Information, Business and Professional Services, Finance and Insurance, Retail Trade, Leisure and Hospitality, and Manufacturing—and highlight some of the features underlying their performance. The percent change in employment in the first quarter of 2019 over a year ago (2019), and the first quarter of 2018 over a year ago (2018) are used to capture recent trends in these industries.

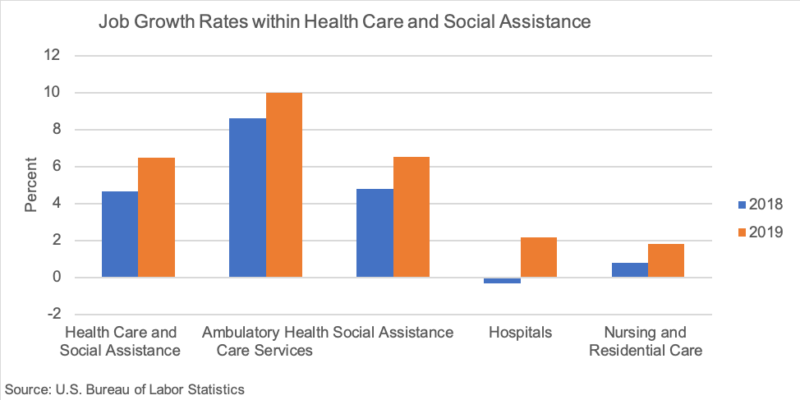

Health care and social assistance had the largest job growth rate over the past year, continuing a pattern of strong annual growth prior to and carrying through the downturn and expansion. Job growth rates in four sub-sectors show that growth is coming from ambulatory care and social assistance, which includes medical offices, outpatient care facilities and home health care providers, and from social assistance providers which include services for the young and elderly and those with disabilities. Hospital employment growth has been relatively slow, a trend also seen nationwide. Demographic trends and changes in the provision of health services underlie these patterns, and the industry will continue to be important for overall city growth.

Employment in construction is relatively cyclically sensitive and declined sharply in the downturn in the city. But since its recovery began in 2011 the industry has been a consistent generator of employment. The level of employment in the major components of the industry are well above their prior cyclical peaks. The information industry includes both traditional publishing outlets as well as establishments in internet publishing, telecommunications, motion pictures, web service portals, and data processing. While employment in non-internet publishers and telecommunications is not expanding, job growth in the other segments in the city has been sufficiently large to continue to yield overall gains for the industry. The professional and business services industry has been a steady force for job growth in the city and with over 750,000 workers, or about 17 percent of city employment, growth here has significant implications for overall city job growth.

A recent pick up in jobs in retail trade has offset the losses seen in 2018. Income growth and spending trends are traditional drives of jobs in the industry, but department and general merchandise stores in both New York City and the nation have been experiencing significant competition as online shopping continues its rapid expansion. This year, however, jobs in these two segments of the industry in the city expanded, a development not seen nationwide. It remains to be seen if the current levels of employment can be sustained.

Employment in the finance and insurance industry expanded, though, at a relatively slow pace in the past two years, with modest gains in jobs in the securities and commodities brokerage (Wall Street) sector. The finance industry is an important part of the city’s economy not so much for its employment numbers but for the fact that, with an average wage in 2017 of roughly $250,000, it generates about 30 percent of annual earnings in the city.

Employment in the city’s leisure and hospitality industry was essentially flat this past year after expanding by about 3 percent in the prior year and being a consistent generator of jobs in this recovery. Gains in several areas were offset by losses in the accommodation and food service component of the industry. Since tourism continues strong and national trends suggest food consumption outside of the home is still growing, the declines could reflect changes in the way in which New Yorkers are consuming food, possibly more consumption of prepared food. These changes in the city warrant a closer look.

Manufacturing firms continue to shed jobs in both New York City and statewide. In a recent article it was pointed out that manufacturing jobs in the nation had declined by almost six million between 2000 and 2010, but employment since then has risen by about one million, much of it in auto and auto-related production locations. The upturn has largely not had an impact either in New York City or New York State, however, with the notable exception of Albany which is successfully developing a nanotechnology cluster.

Outlook

Two reports project that jobs in the city will continue to grow this year and next though likely at a slower pace than in 2018. A variety of factors will combine to influence that growth. One is the national economy where some projected slowing will constrain the ability of a number of industries in the city to expand employment because of their many links to national firms and activity. More locally, as noted here, several developing trends could affect employment, including health care provision, the performance of Wall Street, consumer spending patterns and the competitiveness of the city as a location for internet-related firms and activities. Finally, it remains to be seen how the Tax Cuts and Jobs Act of 2017, which caps the size of the individual federal tax deduction for state and local tax payments, will impact the housing markets in the city in the coming years.