Harvey Gram

July 22, 2018

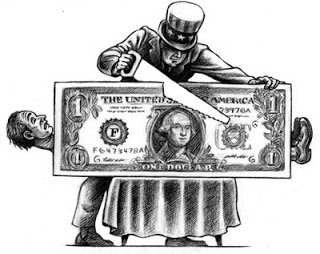

The word “nominal” suggests insignificance. A “nominal tip” is small. “Nominally in charge” means “in name only” i.e. not really in charge. A money-valued variable such as GDP in dollars, pesos, Euros, etc. is described as nominal for much the same reason. Its change may not be “real”. The same thing applies to rates of return. A nominal interest rate of 25% per annum on a government bond with a principal value of $10,000 sounds great: $2,500 per year before taxes. If prices are rising at 25% per annum, however, the real return is zero because the interest payment just makes up for the loss of purchasing power of the principal. In fact, the return is negative after taxes, because nominal income, not real income, is subject to taxation.

Nominal values are, in principle, easy to calculate. In the case of nominal GDP, simply record the dollar value of every final good or service produced over the course of a year—a monumental task, to be sure, but not one requiring any conceptual thought other than to avoid double counting. Count the value of the bread sold, but not the flour used to bake it or the grain that is ground up to make the flour, a likewise for all other goods and services.

Nominal U.S. GDP is about $20 trillion. It passed the $100 billion mark in 1940, indicating a 200-fold increase—about 6.9% compounded annually. How much of this was a result of rising prices and how much was a real increase in the quantities of goods and services produced each year?

The Index Number Problem

Government statisticians calculate a wide range of price indices. The Bureau of Economic Analysis (BEA) publishes the GDP deflator and the Personal Consumption Expenditures (PCE) price index, used by the Federal Reserve to estimate inflation. The Bureau of Labor Statistics (BLS) publishes the headline Consumer Price Index for all Urban Consumers (CPI-U) and the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), used to adjust Social Security Benefits each year (2.0% higher for 2018).

Two basic problems arise in constructing any index number for prices (or quantities). (1) What is the appropriate average of the underlying price (quantity) changes? (2) What should be done to adjust for the fact that a good or service with the same name changes in quality over time while some are essentially new goods and services?

First Problem: Expenditure shares as weights in an average of prices

The Consumer Price Index for Urban dwellers (CPI-U) is a weighted average of eight sub-indexes aggregating 211 categories of goods and services for which the data are collected across 38 geographic areas.

| Category | Expenditure Share | |

| 1 | Food and Beverages | .15 |

| 2 | Housing | .42 |

| 3 | Apparel | .03 |

| 4 | Transportation | .15 |

| 5 | Medical Care | .08 |

| 6 | Recreation | .06 |

| 7 | Education and Communication | .07 |

| 8 | Other Goods and Services | .04 |

The weights on sub-indexes, all the way down to individual ratios of new to old prices, vary because of inflation when expenditure shifts away from goods and services that have increased in price the most towards relatively cheaper ones.

A price index using expenditure share weights that precede price changes is a Laspeyres price index (Ernst Laspeyres, 1834-1913). One that uses weights that follow price changes is a Paasche price index (Hermann Paasche, 1851-1925). The CPI-U is close to a Laspeyres price index (the weights are a little older than the initial prices) and, for that reason, is said to overestimate inflation. It fails to allow fully for the expenditure-share reaction to inflation. This does not mean that a Paasche price index would be any better. It would underestimate inflation because it assumes that the reaction to inflation has occurred before the prices rise.

The BEA compromise is the square root of the product of what are essentially Laspeyres and Paasche price indices. The resulting PCE price index is a Fisher index (Irving Fisher, 1867-1947). It has the advantage that the product of Fisher price and quantity indices yields exactly the factor by which nominal GDP has increased.

The BLS solution is more complex—namely, the product of the ratios of new to old prices for various categories of goods and services, each raised to a power equal to the average of expenditure shares for the current month and the same month a year earlier. The result is a Törnqvist price index (Leo Törnqvist, 1911-1983), called a “chain” index because, as time passes, the end share of one month is the beginning share for the next month.

Second Problem: What’s in a name?

Goods like automobiles can be viewed as “bundles” of various qualities: “safety, reliability, performance, durability, fuel economy, carrying capacity, maneuverability, comfort, and convenience” (BLS Handbook of Methods, chapter 17, page 25). If all qualities were for sale in every time period, the market price of each quality difference could be ascertained. Because this is not the case, various compromises and guesswork must go into deciding whether an increase in price should be counted as inflation or as a real improvement.

In the extreme, an entirely new good or service has no previous price while goods no longer produced have no current price. Music streaming services are entirely new. It would be absurd to stick to the price of vinyl recordings in an effort to measure the change in the price of listening to music. The price of a smartphone compared to a dial telephone raises the same issue. Rapid technological change makes this second aspect of the index number problem at least as important as the first.

A final note

Inflation factors (1 plus the inflation rate) and growth factors (1 plus the rate of growth of the corresponding quantities) ought to “add up”. An inflation factor times a growth factor for the same set of goods and services should equal the corresponding nominal factor (1 plus the rate of change of the nominal value). Now, suppose you have the nominal factor and you have gone to the trouble of estimating the inflation factor. Then, to save time, you just divide the nominal factor by the inflation factor to obtain the real growth factor, and hence the real growth rate. It should be obvious that if you underestimate inflation, you will automatically overestimate real growth. When there is political gain in exaggerating growth, there is political gain in under-estimating inflation. A suspiciously high reported growth rate might just be a consequence of underestimating inflation.

As for the U.S., Tables 1.1.3 and 1.1.9 from the NIPA show that the average annual 6.9% rate of change in nominal GDP since 1940 is accounted for by a virtually equal split between real growth and inflation, each at about 3.4% per year. (The product of the corresponding factors, each equal to 1.034, is 1.069, as expected.) Of course, there was variation around these means. Ignoring the extraordinary swing in the growth rate during and after the Second World War (from 18.9% in 1942 to negative 11.6% in 1946), one still observes a wide range of values from 1960 to the present, ranging from in 7.3% in 1984 to negative 2.8% in 2009. On the inflation side, the extremes of the 1940s again stand out: almost 13% in 1946 followed by a slightly negative number three years later. More recently, 1981 stands out for its high inflation rate of 9.3% while 2009 again enters the record books with inflation at less than 1%. The recent Great Recession was characterized by falling real output and virtually no inflation.