The Economic Studies Group

November 30, 2017

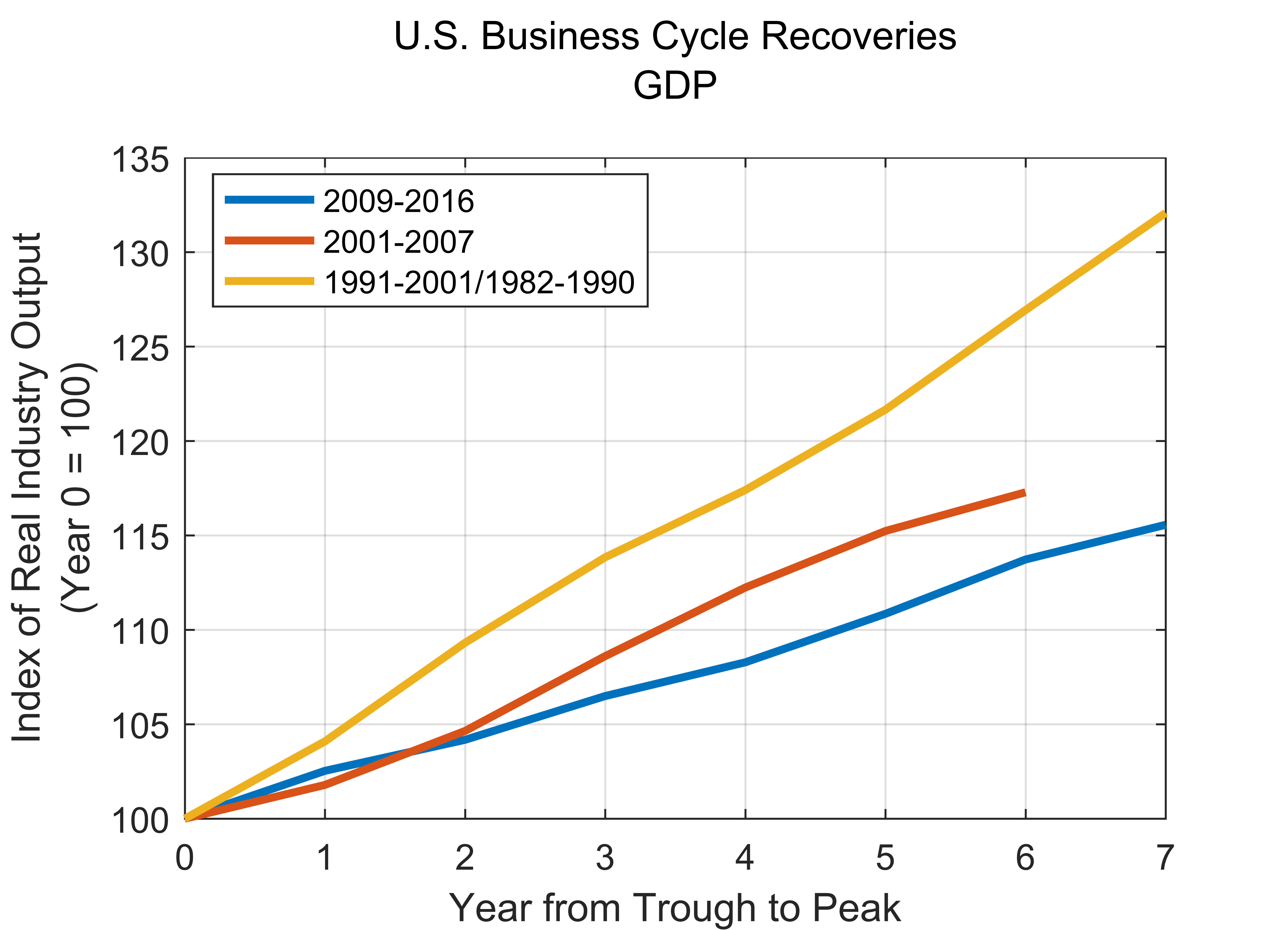

The recovery of activity following the Great Recession got off to a slow start compared to previous cycles. The recession was characterized by deep declines in output (GDP) and the largest increases in the unemployment rate since the 1930s, and it wasn’t until six years into the recovery that the level of aggregate real GDP returned to its potential. In this post, we look at the growth of output in individual industries since the recovery began. While the performance has varied, many industries have also shown a relatively weak recovery, particularly when compared to previous cycles. The analysis indicates that industries are in quite different situations as the economy enters a period of rising interest rates.

The Aggregate Economy

The figure below plots an index of annual real GDP from the formally designated start of the recovery in 2009 (year 0 in the chart) to 2016 and, for comparison, a similar index of real output in the first seven years of previous recoveries. The figure shows that seven years since the downturn ended real GDP is up only 15 percent from the trough. This growth is relatively weak compared to the recovery from the early 2000s recession and to an average of the recoveries in the 1980s and 1990s.

Data Source: Federal Reserve Bank of St. Louis and ESG Calculations

All cycles are different, of course, and the recent recession was preceded by a buildup of unsustainable levels of debt, particularly housing debt, and the subsequent need for a deleveraging of business and household balance sheets. The period was challenging for policy as well. The Federal Reserve (Fed) initially turned to reductions in the Federal Funds rate in an effort to stimulate the economy through the transmission of these lower rates to other short-term market rates. Despite the Federal Funds rate in the range of 0.0 to 0.25 percent, the economy failed to pick up significantly. The Fed turned to what has been described as an unconventional monetary policy, quantitative easing, whereby it purchased bonds, mainly U.S. Treasury and housing agency securities, to help smooth the operation of credit markets. This recovery was notable for the lack of stimulus through fiscal policy. Stimulus packages were passed during the downturn in 2008 and 2009, but fiscal stimulus was far less expansionary in the recent recovery compared to historical averages.

By the end of 2015, the Fed began to increase the Federal Funds rate and by 2017 the economy was showing a number of signs of strength. But the deep recession and slow recovery had been experienced to different degrees across industries.

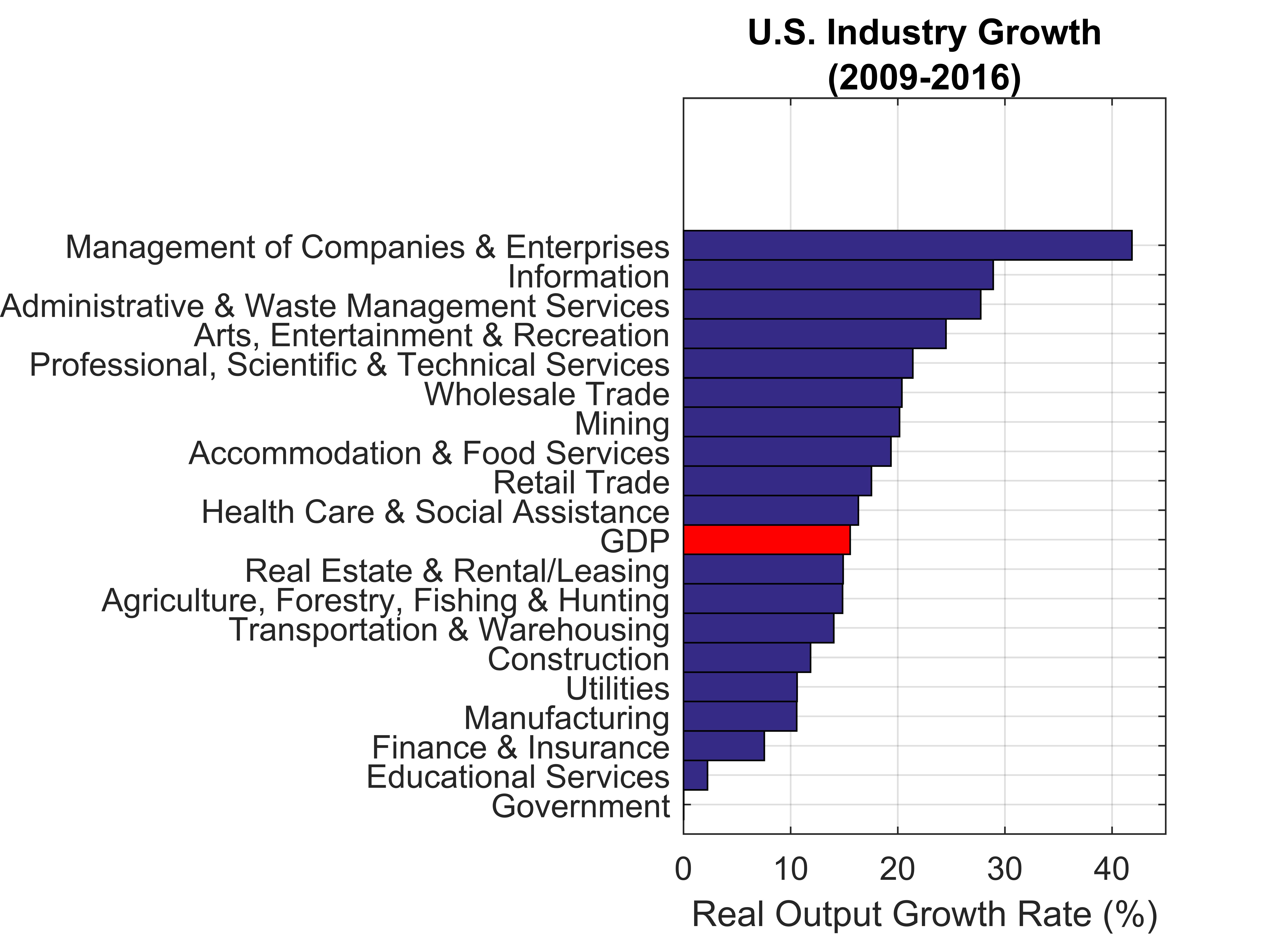

Industrial Performance

Below we show the recent output growth rates in the recovery (2009 – 2016) in a group of 19 industries that together make up the economy. The industry definitions and the corresponding production data are both based on the NAICS (North American Industry Classification System). The list of industries and the growth in their output over the past three years are shown in the figure below.

Data Source: Federal Reserve Bank of St. Louis and ESG Calculations

The top performers include the Information industry, which consists of both traditional publishing firms and electronic publishing outlets as well as firms in the relatively newer areas of data hosting and web service portals, the business-oriented Professional, Scientific and Technical service industry and the more consumer service-oriented Arts and Entertainment industry. Modestly above-average growth is seen in the Healthcare and Social Assistance, Retail Trade (which includes traditional department stores as well as electronic shopping) and the Accommodation and Food Service industries. Weaker growth is seen in the Manufacturing, Educational service and Finance and Insurance industries, and Government.

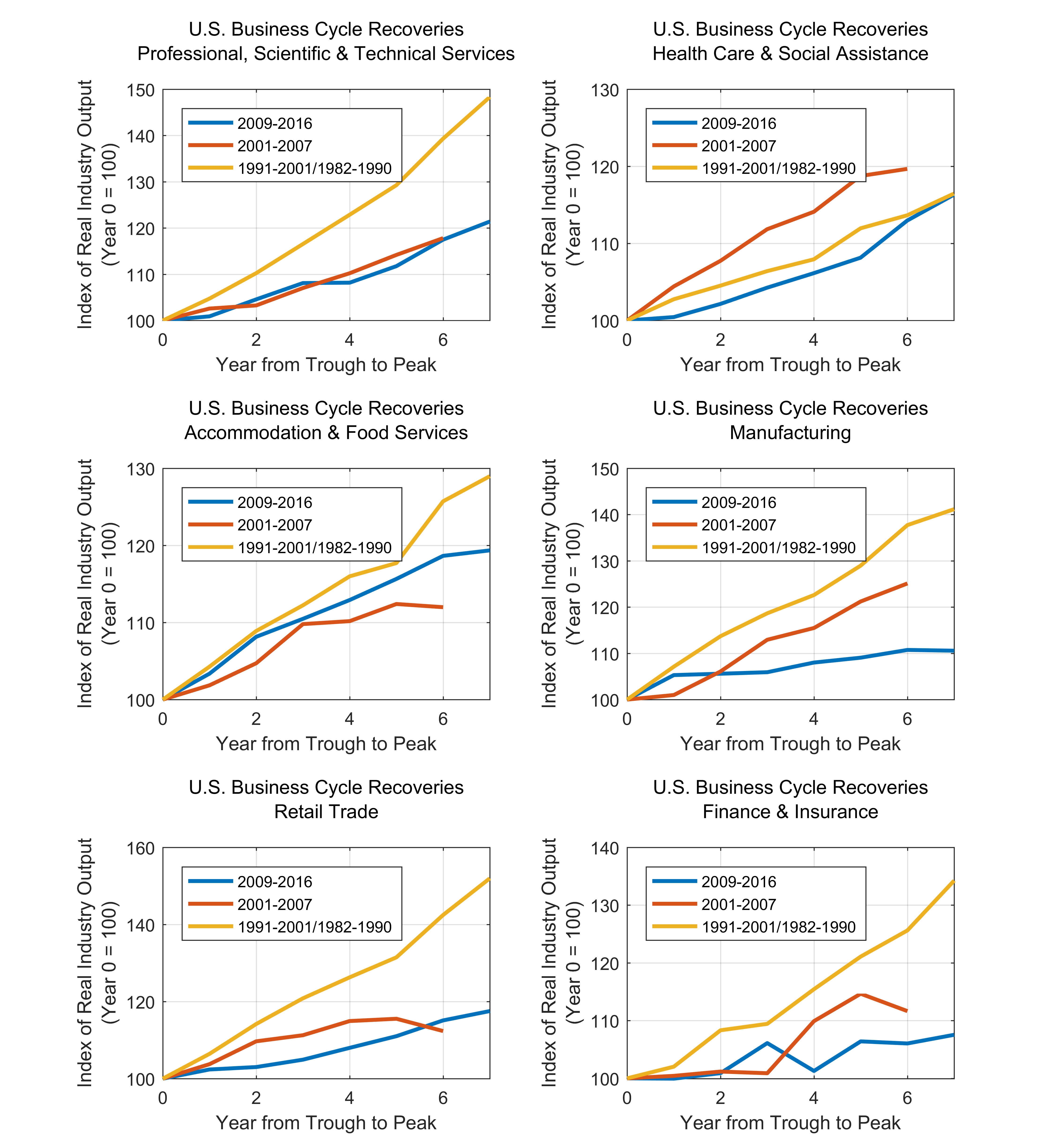

How does the recovery in these industries compare with past recoveries? To answer this question we select several industries. The figures below use the same technique used in the graph of GDP to examine the relationship of the performance of these industries in the current recovery to past recoveries.

Data Source: Federal Reserve Bank of St. Louis and ESG Calculations

Data Source: Federal Reserve Bank of St. Louis and ESG Calculations

The figures show that while the recovery of output in the Professional, Scientific and Technical Services, Accommodation and Food Service and Retail industries was quite strong and roughly on par with the 2000s recovery, in all cases output growth was considerably weaker than in the combined recoveries in the 1980s and 1990s. After a slow start, the growth of output in the Healthcare and Social Assistance industry has matched its growth in the 1980s and 1990s but it is still less robust than its recovery during the 2000s. Both the Manufacturing and Finance and Insurance industries are experiencing the weakest recovery of any of the past cycles.

Going forward, interest rates are projected to rise and the monetary accommodation through quantitative easing to be reduced. How vulnerable these industries are to a monetary tightening will depend on their exposure to a variety of factors:

- The level of corporate debt: Higher interest rates carry risks for industries as they raise the cost of new borrowing as well as the cost of existing debt service thus leading to pressures to curtail operations and put off investments.

- Consumer spending. Higher rates can affect consumer spending as the availability and terms of consumer finance are key factors, particularly for relatively big-ticket items such as automobiles and other durable goods.

- Housing demand. Mortgage interest payments and availability of credit are a key influence on housing affordability.

- International trade and exchange rates. In theory, higher interest rates on U.S. assets increase the demand for dollars and lead to a dollar appreciation. As a result, exports become more expensive in dollar terms abroad and, correspondingly, imports become less expensive to U.S. residents. These effects can be particularly important for U.S. manufacturers of consumer and capital goods that face stiff competition in foreign markets, as well as industries related to travel and tourism.

Thus, we anticipate that sectors such as construction and manufacturing that require big projects consisting of purchases of equipment, machinery, and land will be vulnerable to interest rate hikes for two reasons. First, the cost of undertaking such projects will be higher. Second, the demand for their products depends on consumers’ borrowing that will be impacted by high rates. Manufacturing also has a large export component that is likely to be hurt by potential loss of competitiveness. Sectors such as retail and services sectors are unlikely to be severely affected by interest rate changes since these sectors neither invest in costly long-term projects nor have a demand that require consumer borrowing.